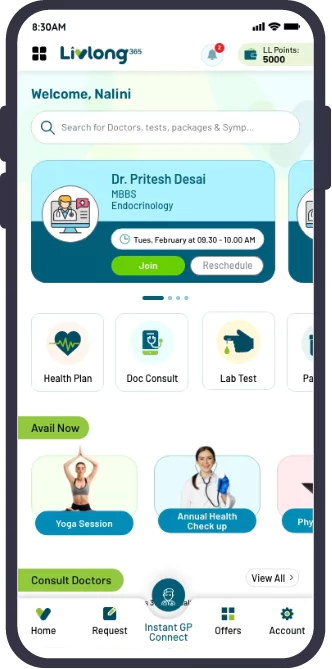

RENEW OR SELECT YOUR COVER

RENEW OR SELECT YOUR COVER

RENEW OR SELECT YOUR COVER

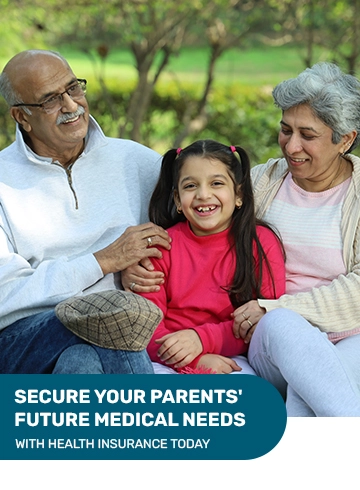

Health Insurance For Parents

Elderly population can easily develop neck pain, back pain, cataracts, diabetes, osteoarthritis, dementia, and depression. Additionally, geriatric people are more susceptible to infections than the rest of the population because of various factors, such as comorbidities and metabolism-related changes. These factors may necessitate you to opt for a health insurance plan for your parents.

What isHealth Insurance For Parents?

A health insurance plan for parents is a policy curated specially for your parents to cover their medical expenses. This policy also covers the costs arising from medical conditions caused by old age. A health insurance policy for parents offers a large sum insured along with remunerative benefits, including cashless treatments and annual heath check-ups, which allow your parents to manage their finances worry free.

A health policy for parents covers for pre-existing conditions in addition to covering for the diseases contracted after getting the policy. The costs for pre-existing conditions can be claimed after the completion of a certain period ranging between one and four years, depending on the policy selected. You can opt for a plan that offers your parents the maximum benefits based on their history. Various factors, such as pre-hospitalization cover, post-hospitalization cover, policy duration, in-patient hospitalization, daycare procedures, and critical illness cover, can be considered while choosing a plan that best suits your parents.

Some health insurance policies also offer a premium health check-up package. Such a health check-up can be claimed annually or as per the terms and conditions of the policy. This ensures that the overall health of your parents can be monitored regularly. In case that a condition is diagnosed during such a regular check-up, your parents can seek the necessary treatment at an early stage of the condition. Moreover, with these regular check-ups, the family members can remain assured and up to date about the good health and life quality of the parents.

Why is aHealth Insurance Plan for Parents Needed?

To make sure that your parents get the best possible medical treatment when needed without being worried about their finances, you can purchase health insurance for parents. As you know, the premium amount for an insurance plan increases considerably with the age. A medical insurance for parents offers you relatively lower premium amounts.

Moreover, geriatric population can develop conditions like neck pain, back pain, cataracts, diabetes, osteoarthritis, dementia, and depression due to their age. Because of comorbidities and metabolic changes, elderly people are more susceptible to infections than the rest of the population. In light of this information, getting your parents insured against any unforeseen medical condition, which may arise due to the old age, becomes necessary. A health insurance plan for parents reduces the stress and financial burden resulting from the abrupt occurrence of an ailment. It also helps your parents lead a stress-free and happy life.

What benefits does a

Medical Insurance Plan For Your Parents Offer?

As the cost for healthcare has been increasing a lot these days, you must be worried about the financial burden a sudden medical event can cause to you and your parents. A health insurance policy lets you and your parents lead a worry-free life with the assurance that your parents will get a timely and high-quality treatment if and when needed.

Some of the benefits of a health insurance plan for your parents are listed here:

Financial security

In an unforeseen medical event, you want to ensure that you and your parents’ finances are not drained. A health insurance plan for your parents covers the costs of a medical treatment, providing you with much-needed financial security in a difficult time.

Save your savings

A medical procedure can lead to expenses, which you or your parents may not be able to cover for immediately with just your regular income. In such a scenario, you may have to depend on your life savings to cover the expenses incurred. A health insurance plan for your parents prevents you from having to face any such situation by covering the costs of the medical treatment, thereby securing your finances from being drained in the time of an emergency.

Compensation for lack of income

It can be hard for your parents to pay for their medical bills from own pocket with pension. A medical insurance plan for your parents takes this into account and minimizes the out-of-own-pocket expenses for your parents, compensating for a lack of income.

Freedom to lead a life free of worry

A health insurance policy for your parents lets them lead their retirement life in a carefree manner with the assurance of coverage for all their medical needs and expenses.

What does a Health Insurance Policy For Parents Cover

A health insurance policy for parents covers the costs incurred from a medical disease. Expenses for the following can be covered with health insurance for parents:

Hospitalization expenses

A surgical procedure or some medical conditions can result in the hospitalization of an individual. This hospitalization can lead to high expenses. A health policy for parents covers these expenses up to the coverage limit.

Pre- hospitalization and post-hospitalization expenses

In addition to the costs of hospitalization, a health policy for parents covers the medical expenses incurred prior to hospitalization.

Mental healthcare

Various factors, including the conditions arising from old age, can take a toll on the mental health of an elderly person. Keeping this in mind, health insurance for parents also covers the costs of mental healthcare.

Day care procedures

With the advances in medical sciences, day care treatments have emerged, reducing the time required for some surgical treatments. Health insurance for parents covers the expenses of these day care treatments as well.

Home Healthcare

In case that your parents opt to be treated at home with the approval of the doctor, a health insurance policy for parents can cover the cost for the treatment. Your parents can get the treatment in the pleasant environment of their own home.

Sum insured rebound

With this feature, your parents get coverage for their medical treatment and hospitalization even when the sum insured is exhausted.

Organ donor expenses

In case that your parents require an organ transplant, they can proceed with their treatment entirely worry free as a health insurance policy for parents covers the costs of an organ donor as well.

Free renewal health check-up

Some health insurance policies for parents also provide a free health check-up post the renewal of the policy.

Lifelong renewability

A health insurance policy for your parents offers the renewal option for lifetime.

Multiplier Benefit

If a health insurance plan for parents is not claimed in the first year, some policies increase the insurance amount by up to 50% in the subsequent year.

Hospitalization expenses

A surgical procedure or some medical conditions can result in the hospitalization of an individual. This hospitalization can lead to high expenses. A health policy for parents covers these expenses up to the coverage limit.

Pre- hospitalization and post-hospitalization expenses

In addition to the costs of hospitalization, a health policy for parents covers the medical expenses incurred prior to hospitalization.

Mental healthcare

Various factors, including the conditions arising from old age, can take a toll on the mental health of an elderly person. Keeping this in mind, health insurance for parents also covers the costs of mental healthcare.

Day care procedures

With the advances in medical sciences, day care treatments have emerged, reducing the time required for some surgical treatments. Health insurance for parents covers the expenses of these day care treatments as well.

Home Healthcare

In case that your parents opt to be treated at home with the approval of the doctor, a health insurance policy for parents can cover the cost for the treatment. Your parents can get the treatment in the pleasant environment of their own home.

Sum insured rebound

With this feature, your parents get coverage for their medical treatment and hospitalization even when the sum insured is exhausted.

Organ donor expenses

In case that your parents require an organ transplant, they can proceed with their treatment entirely worry free as a health insurance policy for parents covers the costs of an organ donor as well.

Free renewal health check-up

Some health insurance policies for parents also provide a free health check-up post the renewal of the policy.

Lifelong renewability

A health insurance policy for your parents offers the renewal option for lifetime.

Multiplier Benefit

If a health insurance plan for parents is not claimed in the first year, some policies increase the insurance amount by up to 50% in the subsequent year.

What conditions are not covered under a

Health Insurance Plan For Your Parents?

Some health insurance plans for parents do not cover the costs for diseases and conditions, which are diagnosed within 30 days of buying the plan. A few of the other conditions that are not covered under a health insurance plan for parents are as follows:

Adventure sport injuries

People choose adventure sports for adrenaline rush. A health policy for parents does not cover the expenses resulting from adventure sports.

Self-inflicted wounds

Health insurance for parents does not cover the medical expenses for any self-inflicted injuries.

War

If an injury is sustained in a war, medical insurance for parents does not pay for the treatment of the injury.

Injuries sustained in defense operations

Similar to war-sustained wounds, health insurance for parents does not cover the expenses for injuries sustained in defense operations.

Sexually transmitted diseases

The treatment costs of a venereal or sexually transmitted disease are not covered by some health insurance policy for parents.

Adventure sport injuries

People choose adventure sports for adrenaline rush. A health policy for parents does not cover the expenses resulting from adventure sports.

Self-inflicted wounds

Health insurance for parents does not cover the medical expenses for any self-inflicted injuries.

War

If an injury is sustained in a war, medical insurance for parents does not pay for the treatment of the injury.

Injuries sustained in defense operations

Similar to war-sustained wounds, health insurance for parents does not cover the expenses for injuries sustained in defense operations.

Sexually transmitted diseases

The treatment costs of a venereal or sexually transmitted disease are not covered by some health insurance policy for parents.

Different health insurance plans may not provide coverage for only one or various combinations of the aforementioned scenarios.

Things to consider before buying a

Health Insurance Policy For Parents

The entire process of selecting a health insurance plan for your parents can be overwhelming. The wide range of policy options available for parents in the market may even lead to puzzlement instead of facilitating the selection process. In such a situation, making sure that you are aware of what benefits you are getting from the chosen policy becomes highly critical.

To avoid such puzzlements, you must take the following factors into account before choosing a health insurance plan for your parents. These factors can facilitate the overall policy selection process for you in addition to reducing the confusion arising from the large number of choices available.

Health insurance coverage

You must consider the coverage of health insurance before buying a policy. Different policies provide coverage for different treatment combinations for various diseases, such as day care procedures and critical illnesses.

Sum insured

To make sure that your parents’ medical expenses are completely covered and their medical requirements are met, you must opt for a plan that offers the highest coverage possible.

Pre-existing disease coverage

You should take into account any pre-exiting conditions or ailments that your parents may have before buying a policy. You can choose an option that provides cover even for pre-existing conditions. Depending on the severity of a condition, you can choose for policies that cover the costs for pre-existing conditions after the completion of 1–4 years.

Co-payment clause

Under this clause, you will have to pay a specific amount of the treatment expense from your pocket. You can choose a policy with a “no co-payment” clause.

Sub-limit help

Both the costs for room and the treatment are covered under a policy. The expenses of the room type are also considered under the coverage. Thus, you should look for a policy that has no sub-limit on the hospital room rent. With this consideration, you can select a hospital room that suits your requirements the best.

Tax benefits

You can claim tax deduction for the premiums that you pay for the health insurance policy for your parents. If the age of your parents is less than 60 years, you can claim for a tax benefit of up to 50,000 rupees per year for the premium. If the age of your parents is more than 75 years, you can claim for a tax benefit of up to 75,000 rupees per year for the premium.

How to choose the best

Health Insurance Plan For Parents?

Numerous heaths insurance policies for parents are currently available in the market for you to choose from. You should compare different policies in order to choose the one that meets all of your requirements. To opt for the plan that best caters to yours requirements, you can consider the following features:

1.

Highest coverage

You should review the limitations and inclusions of a policy before purchasing it. Due to the susceptibility of geriatric population to a number of conditions, you should opt for a plan that offers coverage for a large number of diseases and ailments. You can also take the sum insured into account depending on the premiums paid.

2.

Entry age

Some of policies allow entry even at an advanced age of more than 60 years. If the age of your parents is above 60 years, you can opt for one of these policies.

3.

Renewal policy

Some plans provide lifetime renewal for a policy. You can take this factor into account to ensure that the medical expenses for your parents will be covered for lifetime.

4.

Waiting period for pre-existing conditions

Some policies cover the costs of a pre-existing condition after one year of getting the policy. However, this waiting period differs with the policy. You can opt for a plan with the lowest waiting period if your parents already have a medical condition.

5.

Network hospitals

You can review the hospitals listed under a policy for cover to determine if the best hospital near your parents is covered for by the policy.

6.

Flexibility

Different policies provide different flexibilities. You can opt for a plan that offers maximum flexibility for various factors such as renewal, coverage, and the insured sum.

7.

Premium amount

The amount of premiums increases with the age of the person being insured. You can look for a policy that meets your requirements with the lowest premiums.

8.

Claim process

You can also consider the claim procedure of a policy before buying it. An easy claim process reduces your emotional burden and saves a lot of your time in a difficult situation. You should also make yourself aware of the claim process in advance to avoid any stress that may arise from it.

9.

Co-payments

If a co-payment policy best suits your requirements, you can also consider a plan with a low co-payment structure.

How can you claim

Health Insurance For Parents

You may feel stressed in a situation when one of your parents may have to be hospitalized abruptly. In such a case, you may find it helpful to make yourself aware of the claim process followed by your policy.

The following steps give you a general idea about the process of claiming a health insurance amount for your parents.

1.

To get the approval for a cashless treatment, you should fill a pre-authorization form at the network hospital.

2.

The hospital will informs the insurance company about the cashless claim, and then, the insurance company will share a status update with the hospital.

3.

Once you receive pre-authorization approval, you can hospitalize your parent.

4.

When your parent gets discharged from the hospital, the company will pay the hospital directly.

To get the approval for a cashless treatment, you should fill a pre-authorization form at the network hospital.

The hospital will informs the insurance company about the cashless claim, and then, the insurance company will share a status update with the hospital.

Once you receive pre-authorization approval, you can hospitalize your parent.

When your parent gets discharged from the hospital, the company will pay the hospital directly.

than Health Insurance?

Health Insurance For Parents FAQ'S

Join 2,00,000+ subscribers who get personalised health tips in their inbox

Buy Health Plan