Your family is your greatest treasure, and you must do everything to secure them – from their health to their finances. One way to achieve that goal is to invest in health insurance plans. A family health insurance plan allows you to cover all your immediate family members under one plan. Under such plans, all insured members share one sum insured and can file multiple claims throughout the policy year until they exhaust the sum insured amount.

A single family health insurance plan typically covers up to six members in the family – yourself, your spouse, up to two children and your parents. This feature makes family health insurance one of the most affordable plans that cover your entire family’s needs. Additionally, you can enjoy all the primary advantages of medical insurance with the best health insurance plans for family. For instance, you can benefit from the no-claims bonus facility leading to an enhanced sum insured or a discount on insurance premiums. Insurers also allow you to enhance your sum insured voluntarily with the sum insured top-up facility.

Scope Of Coverage In Family Health Insurance Plans

The best health insurance plans for family members provide all-encompassing coverage, addressing most, if not all, your medical needs. The general inclusions under family health insurance plans include the following.- Hospitalisation Expenses: The insurer covers you for the costs associated with hospitalisation in the event of urgent or planned medical treatments. Hospitalisation expenses usually include surgery and nursing costs, boarding (room rent) expenses, doctor consultations during the hospital stay, and more. You can check the detailed schedule of hospitalisation coverage under the policy terms.

- Medical Conditions: Your family health insurance plan covers the hospitalisation costs associated with most health conditions, illnesses, and injuries. You can seek treatments for cancers, cardiovascular diseases, mental health ailments, dengue, fever, and other regular and critical illnesses. The best medical insurance for family plans also include coronavirus treatment coverage.

- Pre & Post-Hospitalisation: Your insurance provider covers the costs associated with medical tests, diagnostic costs, blood tests, X-rays, doctor consultation costs, etc., required before and after hospitalisation. These costs are categorised as pre and post-hospitalisation costs. Insurers generally cover the costs borne by the policyholder up to 30 days prior to and up to 60 days after being discharged from the hospital.

- Day Care Treatments: Most insurers cover the cost of several day care treatments. They do not mandate overnight hospitalisation for certain treatments completed within a few hours. Thus, if your family members need to undergo treatments like chemotherapy, radiation, dialysis, angiography, etc., which take only a few hours, the insurer covers the expenses of the same.

- Daily hospital cash: If your medical condition is severe, requiring you to spend more time under the hospital’s observation, insurers make provisions for a daily hospital cash benefit. Besides the room rent, the insurer provides an allowance to enable you to bear the extra costs for each day of hospitalisation recommended by your medical practitioners.

- Domiciliary Hospitalisation: In case the doctor recommends that a policyholder be hospitalised at home, the insurer covers the cost of such domiciliary hospitalisation as well. The insurer sets a cap or sub-limit on the per day cost of home hospitalisation.

- E-opinion: If your medical diagnosis is unsatisfactory and you wish to consult another medical expert, you can do so at no extra cost by utilising the e-opinion facility. You can inform your insurer about your intention to seek an e-opinion, and the insurer arranges the same for you with a hospital within their network.

- Alternative Treatments: Per a mandate by the Insurance Regulatory Authority of India (IRDAI), you can seek alternative treatment forms besides allopathy, and your insurer is mandated to cover the costs of the same. The insurer, therefore, is obligated to cover the costs of alternative treatments such as Ayurveda, Yoga and Naturopathy, Unani, Siddha, and Homeopathy under health insurance coverage.

- Ambulance Services: The best health policy for family plans also includes ambulance coverage services. Your medical insurance plan may cover the cost of road ambulance services up to a specific sub-limit or as part of the sum insured. You may also purchase an add-on rider for air ambulance services at an extra cost.

- Organ Donor Expenses: The insurer covers organ donor expenses if you or a family member covered under the medical insurance plan for family needs to undergo an organ transplant surgery. Insurers usually cover the donor’s hospitalisation costs but are not liable to cover their pre and post-hospitalisation costs.

Health Insurance Plans For Family – The Salient Features

The best medical insurance for a family typically comes loaded with some excellent features, including the following:- One Plan For All Needs: A family health insurance plan allows you to address the various health needs of your family members under a single plan. By paying a single premium covering all your family members, you can ensure they get medical coverage against various physical and mental ailments per the policy terms. Insurers consider the health conditions of all the insured parties and the eldest family member’s age while determining the premium amount.

- Flexible Policy Term: You can choose between single and multi-year health insurance plans for family. While you must renew the single-year plan every year, insurers permit you to renew multi-year policies every two to three years. Moreover, insurers offer discounts on multi-year policy premiums. Additionally, you can enjoy the regular benefits associated with single-year policies, such as the no-claims bonus benefit.

- Waiting Period: All medical insurance plans, including health insurance plans for family, come with waiting periods. During this time, if you need medical treatment, the insurance company is not obligated to accept or process your claims. The waiting period typically lasts for one to six months from the policy purchase date, depending on your insurer. However, insurers approve claims if policyholders have been in an accident and need medical treatment.

- Sum Insured Options: Depending on the type of coverage you need, you can choose from a range of family health insurance plans with varying sums insured. Insurers offer family health plans ranging from sums insured starting from ₹3 lakhs up to several lakhs. The maximum coverage differs from one insurer to another, so you must research the best health insurance policy for family before shortlisting an insurer.

- No Claims Bonus: Insurers provide discounts or enhance your policy’s sum insured during the first few years with a reward known as the no-claims bonus. To qualify for this reward, you must ensure you do not file insurance claims during a policy year. Typically, insurers enhance your sum insured amount by 50% of the original sum insured for five consecutive claim-free years. Some insurers may also reduce the premium amount while keeping your coverage terms intact.

- Coverage Modification: Another excellent feature of the best medical policy for family is that you can effortlessly modify your coverage. You can add or remove existing members, add-on riders, etc., based on your changing medical needs at the time of policy renewal. Some insurers allow you to add your newborn baby soon after birth, and you need not wait to add the toddler to the insurance plan until the renewal period.

- Health Insurance Plans For Family – The Benefits

- You can enjoy the following benefits of investing in medical insurance plans for family members.

- Restoration Benefit: In the event that your family exhausts the sum insured under your health plan before a policy year ends, you may restore it using the restoration benefit rider. You must purchase the rider at the time of buying or renewing the medical insurance plan for family. This rider allows you to partially or entirely restore the policy’s sum insured amount in the middle of the policy year, thus reducing your out-of-pocket expenses in case your medical costs exceed the sum insured amount.

- Lifetime Renewability: Per IRDAI guidelines, insurers are obligated to provide uninterrupted coverage throughout your lifetime. They must continue providing insurance benefits once you reach a certain age. However, to ensure you can get continuous insurance coverage, you must renew your policy on time. The lifetime renewability benefit ensures you do not lose insurance coverage during your old age.

- Flexible Premium Payment: To make medical insurance affordable, the IRDAI passed yet another mandate stating that policyholders can pay insurance premiums in instalments. Thus, you do not have to worry about paying a lumpsum amount each year. You can, instead, pay your insurance premiums in monthly or quarterly premiums.

- Customisation Benefits: Insurers allow you to customise your policy to suit your needs with the help of different additional riders. These riders allow you to enhance your coverage for a slightly higher premium. Some popular add-on riders you can select to custom-create the best health policy for family include sum insured restoration, critical illness cover, co-payment waiver, room-rent waiver, hospital cash cover, etc.

- Free Health Check-up: Your insurance provider allows you to get free routine health check-ups as a reward for not filing claims during a policy year. All the insured members under medical insurance plans for family can undergo a health check-up at one of the medical facilities within the insurer’s network at no extra cost. The insurer determines the frequency of annual health check-ups and reimburses the network hospital directly.

Tax Benefits of Investing in Medical Insurance Plans For Family

The Government of India provides tax deduction benefits on various investments, including medical insurance plans. Under this benefit, you can enjoy annual tax deductions ranging from ₹25,000 to ₹100,000 per annum for investing in health insurance plans. The maximum tax deduction you can avail of depends on the ages of the insured parties and the individual purchasing the health insurance plan for family members. Thus, whether you buy individual health insurance plans for family members or choose a family health insurance plan, you can claim tax deductions as under:- ₹25,000 per annum for purchasing health insurance plans covering yourself, your spouse and your children (immediate family). You should be below 60 to obtain this maximum annual tax deduction.

- ₹50,000 per annum for purchasing health insurance plans covering your immediate family and your dependent parents. Both you and your dependent parents need to be under 60 years to obtain this maximum annual tax deduction.

- ₹75,000 per annum for purchasing health insurance plans covering your immediate family and your senior citizen dependent parents. While you may be below 60 years, your parents should be above 60 for you to obtain this maximum annual tax deduction.

- ₹100,000 per annum for purchasing health insurance plans covering your immediate family and your senior citizen dependent parents. While your spouse and children can be below 60 years, you need to be above 60 to obtain this maximum annual tax deduction.

Eligibility Criteria for Buying Family Health Insurance Plans

To purchase a family medical insurance plan, you need to comply with the insurer’s eligibility requirements which are as follows.- Nationality: You should be a resident Indian to purchase family health insurance plans. Also, you can seek treatment in Indian hospitals and healthcare centres only.

- Age: Family health insurance providers allow you to cover all members of your kin under the health plan, irrespective of their age. The insurance buyer needs to be above 18 years of age, and the purchased policy can cover the buyer, their spouse, and their young children (including newborn babies). Some insurers may also allow you to include your parents in the health plan, but age restrictions may apply depending on the insurer.

- Health Condition: Whether or not you are eligible for family health insurance also depends on your health condition. When purchasing the policy, you must declare your medical history of critical illnesses, such as cancer, kidney problems, heart ailments, etc. You can obtain insurance despite pre-existing conditions, but the insurer may levy a higher premium. You may also have to ride out longer waiting periods before filing a claim.

Difference Between Individual And Family Health Insurance Plans

When choosing the best health insurance plans for family members, it helps to compare them to individual plans to assess the benefits, coverage, and costs associated with the two policies.- Coverage: An individual medical insurance plan covers only one family member. Also, the coverage and benefits applicable to the plan can be obtained only by that insured member. The insured individual cannot transfer the benefits to another family member. On the other hand, a family insurance policy covers all family members under a single plan.

- Premium Costs: Individual health insurance plans are generally more expensive than medical insurance plans for a family. You need to pay a separate premium for every individual policy purchased. In contrast, family insurance plans are more affordable and cost much less. Such plans are ideal for a family unit that includes young members in their 20s and 30s, with young and healthy children, less likely to fall ill and file insurance claims.

- Convenience: If you purchase individual health insurance policies for your family members, you need to renew each policy separately. The policy renewal date may also differ for each individual policy. However, if you opt for family medical insurance plans, you can renew coverage for all family members at one go. You do not have to keep track of the different policy renewal dates.

- Sum Insured Distribution: Every insured member under an individual health insurance plan gets a separate sum insured, whereas all the insured members under a family health plan must share the sum insured amount. However, there is no specific distribution of the sum insured amount. Thus, if only one member needs treatment, they can utilise the entire sum insured in the family policy. If another member needs treatment at another time during the policy year, and the sum insured is exhausted, the insured parties must bear the costs out of their pockets.

How Do Insurance Providers Determine The Premiums Costs of Family Health Insurance Policies?

With health insurance, there is no one size fits all mantra. Insurers consider various factors unique to the parties insured and then decide the premium costs. They include the following.- Type of Coverage: The most significant factor that impacts your premium costs is the type of coverage you choose. While the cost of a base plan may be inexpensive, your premiums will increase if you opt for additional riders. Based on your insurance needs, you can create the best health insurance plan for family members, featuring a variety of riders for all-encompassing, enhanced coverage.

- Age of the Eldest Family Member: Your age largely determines the cost of your health insurance policy. Insurers typically consider the age of the eldest family member under the family medical insurance plan and quote the premium amount accordingly. The premiums costs may be lower if all the family members under a plan are under the age of 40 years.

- Medical History of Insured Members: Insurers also assess the medical history of the insured parties to determine the premium costs. If the parties insured have no medical history of serious conditions, you can buy the best medical insurance for family members without worrying about high premiums. Contrarily, if any family member has been diagnosed with severe health conditions or has any pre-existing illnesses, the premium costs can shoot up considerably.

- Location: The cost of medical insurance also depends on the city you live in and its prevalent health infrastructure. The medical facilities available in urban areas like metros, tier II and tier II cities are generally advanced, which reflects in the treatment costs. Thus, insurers generally levy higher premium costs from policyholders residing in such areas. On the other hand, the treatment costs are more affordable in smaller cities, towns and rural areas, leading to lower premium costs.

- Lifestyle Choices: An insured member’s lifestyle choices also dictate their insurance costs. If you consume alcohol, smoke habitually, or indulge in other unhealthy practices, the insurer may charge you higher premiums. This is because lifestyle choices like smoking and alcohol consumption make you more prone to severe health issues, increasing your likelihood of filing claims.

Exclusions under Family Health Plans

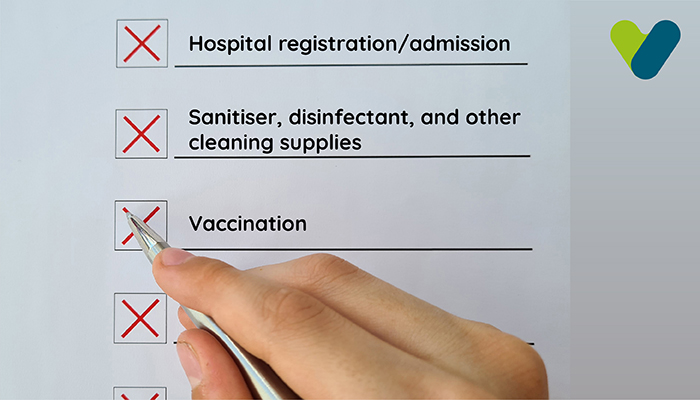

Your family health insurance policy covers the medical costs of most ailments. However, insurers do not provide coverage for hospitalisation and treatment under the following circumstances.- Congenital Diseases: Insurers do not cover the costs of treatment of physical ailments you are born with, i.e., congenital diseases. If you wish to get coverage for the same, you can buy a pre-existing ailments add-on rider.

- Sport-related Injuries: Insurance policies cover the costs of illnesses, diseases, and injuries resulting from accidents. They are not obligated to bear the medical expenses arising from sports-related injuries.

- Self-harm : Self-harm, including suicide attempts, are also not inside the scope of health insurance coverage. If a policyholder inflicts self-harm or tries to commit suicide and is hospitalised for the same, the insurer does not accept claims.

- War: Any bodily injuries caused to policyholders due to their active participation in activities such as war, civil unrest, political strife, riots, etc., and leading to hospitalisation, are not applicable for health insurance coverage.

- Substance Abuse: Insurers are not obligated to approve hospitalisation and treatment claims if the policyholder’s deteriorating health is attributed to addiction to intoxicating substances like drugs, alcohol, nicotine, etc.

- STDs: Insurance providers do not cover the medical cost of treating sexually transmitted diseases such as HIV and AIDS. This type of coverage is excluded under all health insurance plans, including medical insurance plans for family.

- Cosmetic Treatments: Your health plan does not cover the costs of cosmetic enhancements, including dental braces, rhinoplasty, and plastic surgery. However, insurers will cover the costs of plastic surgeries following accidentally acquired or forcefully induced burns (as in the case of acid victims).

- Gender Reassignment Surgery: Among the list of exclusions under the best medical policy for family is gender reassignment surgery. Such a surgery is not considered medically necessary and is outside the scope of coverage.

How To Choose The Best Health Insurance Plan For Family?

Choosing the best health insurance policy for family involves some research. It helps to take into account some vital factors before shortlisting the best policy suiting your needs. Here’s what you must take into consideration.- Coverage and Benefits: While choosing the best health plan for your family, you need to assess the type of coverage provided by the insurer basis the premiums charged. Ensure your chosen plan covers most of the basic inclusions, and check the extent of add-on riders you can select. Additionally, you must compare the benefits offered by various insurers and shortlist a plan with maximum benefits.

- The Insurer’s Claim Settlement Ratio: The most critical component to consider while choosing a health plan is the insurer’s claim settlement ratio. Expressed as a percentage, this ratio gives you insight into the number of claims your insurer receives, approves, and rejects in any given year. Consider choosing insurance providers with claim settlement ratios exceeding 85%. You can check the different insurers’ claim settlement ratios on the IRDAI website.

- The Insurer’s Network of Hospitals: As a policyholder, you must ensure you choose an insurer with a wide network of hospitals, healthcare facilities, alternative treatment clinics, etc. An extensive healthcare network allows you to easily seek cashless treatments without worrying about making up-front payments. You must check if hospitals within your vicinity are included within the network while choosing the best health insurance plans for family.

- The Insurer’s Customer Support Network: During a medical emergency, you should be able to reach your insurer’s customer care network without any hassles. It is, therefore, essential for you to check whether you can get quick responses from your insurer. One way to assess the insurer’s customer support network is through online reviews and testimonies from existing customers.

- The Waiting Period Associated with the Policy: Insurers do not entertain claims during the waiting period. This means that you cannot file an insurance claim even if you are in a medical emergency (besides accidents). Thus, while selecting the best medical insurance for family, you must check the waiting period. Depending on the insurer and the type of family health insurance plan, the waiting period can range from 3 months to a few years.

- The Option to Enhance the Sum Insured: Yet another vital criterion to consider while choosing an insurer is whether they provide the option to enhance the sum insured limit. Check if the insurer allows you to restore the sum insured partially or completely after exhausting it during a policy year. Some insurers allow you to increase your sum insured by 50% (under the no-claims bonus benefits), while others may provide 100% or higher restoration facilities.

- Deductibles, Co-Payments And Sub-limits: Lastly, you must check the sub-limits, deductibles, and co-payment plans associated with the insurance policy. Check if the sub-limits on room rent, hospital daily cash, domiciliary expenses, etc., are sufficient. Also, assess if your chosen family medical insurance plan includes deductible and co-payment clauses. Such clauses may reduce your insurance premiums but increase your out-of-pocket expenses at the time of hospitalisation.

How To Buy Family Health Insurance?

You can buy the best health insurance plans for family members online and offline in India. Here are the steps.The Online Process

- Research the various insurance companies offering medical insurance plans for family after assessing their claim settlement ratio, customer service facility, etc., and shortlist your preferred insurer.

- Visit your chosen insurer’s website (or third-party aggregator site), compare the different plans your chosen insurer offers and check the coverage provided, premium costs etc.

- Choose your preferred policy and fill out the form to purchase it by providing the details prompted in the form.

- Attach scanned copies of documents like your age, ID and address proof documents, previous medical records (if applicable or asked by the insurer), etc.

- The insurer assesses your documents and e-mails you the policy documents.

You also have the option to purchase your preferred medical insurance plan offline or the traditional way, i.e., through an insurance agent or broker. Such individuals suggest policies after assessing your requirements, collect the documents from you and submit them to the insurer. Once the insurance provider creates the policies in your name, the agent/broker hands over the insurance documents to you.

Whether you choose the online or offline mode, note that insurers may also ask you to undergo a medical check-up at your own expense, if applicable, before releasing the policy document.

How To File Family Health Insurance Claims?

You can choose your preferred method from these two methods of filing health insurance claims.- Cashless Claims

- The insurer’s representative, a third-party administrator (TPA), contacts the hospital staff.

- The TPA and the hospital staff collate original copies of the hospitalisation bills and other expenses incurred during the policyholder’s treatment period.

- The TPA then asks you to provide the pre and post-hospitalisation bills applicable to your treatment course.

- The TPA submits the documents to the insurance provider.

- The insurer assesses the claim and pays the hospital directly for the expenses incurred during your stay there.

- Reimbursement Claims

- Seek admission in your preferred hospital and complete the treatment course.

- Contact the insurer after being discharged to get the claim filing form.

- Collect all the original bills and photocopies of documents associated with the treatment (prescriptions, suggested tests, diagnostic reports, etc.) and fill out the claim reimbursement form. Don’t forget to include the bills associated with pre and post-hospitalisation expenses.

- The insurer’s representative, a TPA, will contact you to collect the documents.

- The TPA then hands over the documents to the insurer, who evaluates your claim and reimburses you for the expenses incurred.

Documents Required To File Family Health Insurance Claims

You must submit the following documents while raising a family health insurance claim.- The duly-filled claim application form.

- A copy of the family health insurance policy document.

- A copy of your age, identity and address proof documents

- All original bills associated with the treatment for which the claim is raised.

- Photocopies of prescriptions, diagnostic tests, medical reports, etc.