A health insurance plan is a convenient solution for tackling unexpected medical emergencies. You can rely on it to handle the inflating medical expenses while you get through the situation without financial stress. You also get a vast range of costs covered under the policy to meet your healthcare requirements. Insurers facilitate this through the base coverage and optional add-ons. However, this does not mean that a medical insurance plan is a solution for all kinds of medical expenses. There are certain costs not covered under the plan.

The Insurance Regulatory and Development Authority of India (IRDAI) proposed a list of non-payable items in health insurance. They are also known as out-of-pocket expenses that you bear on your own. This is to follow a strict claim process and eliminate the chances of misuse of health insurance for raising unnecessary claims. Knowing them helps set your expectations right and avoid surprises during the claim settlement process.

Non-medical expenses in health insurance as per IRDAI

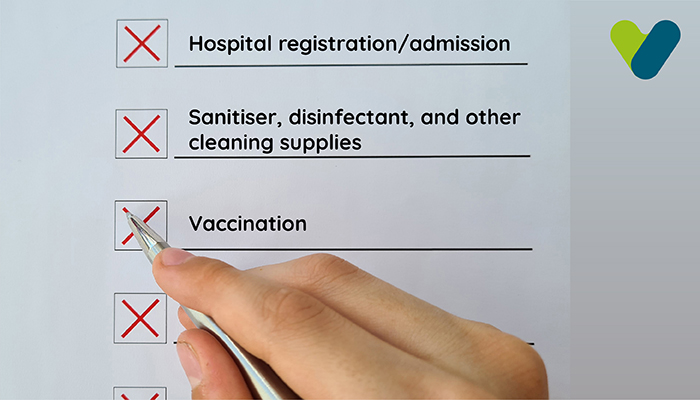

Based on the IRDAI guidelines, non-medical items in insurance get divided into several categories. They get mentioned under the exclusion section in your health insurance policy. Find the breakdown of such categorisation as follows:Treatment-related exclusions

The costs incurred on the following procedures or items during a treatment qualify as non-medical expenses in insurance:

- Hospital registration/admission

- Sanitiser, disinfectant, and other cleaning supplies

- Vaccination

- Appointment of dietician or nutritionist

- Urine container

- Hospital footwear

- Blood reservation

- Infusion pump

- Antiseptic mouthwash

- HIV test kit

You may use certain items during your stay in the hospital room. Some of them come under the list of non-medical expenses in health insurance. They are as follows:

- Tissue papers

- Hand wash

- Hospital gown

- Pulse oximeter

- Toiletries

- Slippers

- Hot/Cold compressing packs

- Comb, buds, and caps

Certain supplies used during medical procedures add up to the costs. Some of them are termed non-medical items in insurance and do not get covered under the policy. Examples include:

- Cotton and bandages

- Surgical blade

- Arthroscopy and Endoscopy instruments

- Eye pads

- Surgical drill

- Apron

- Harmon scalpel blade

- Disposable razors

- X-ray films

- Gauze

- Hair removal cream

- Ortho or Gynaec bundle

- Microscope/camera cover

You may find some items helpful during your stay in the hospital for comfort. But they are not directly related to your medical care. Hence, they are treated as non-medical expenses in insurance. Such items include:

- Carry bags

- Food and beverage not provided in the hospital

- Thermometer

- Nebuliser kit

- Braces/belts

- Laundry service

- Baby food and utilities

- Beauty services

- Television and internet connection

Besides the charges mentioned above, some other non-payable items in health insurance are:

- Medicine box

- Needles and syringes

- Gloves

- Digestion supplements

- Powder, brush, towels

- Barber charges

- Washing charges

- Referral doctor's consultation fees

Learning more about non-medical items in insurance

The abovementioned list covers the range of expenses not covered under health insurance as per the IRDAI guidelines. Every medical insurance company in India must adhere to these guidelines while creating the exclusions clause. While they add these items as non-medical expenses in health policy, they are also free to add other costs. Hence, it pays to study the insurers' terms carefully to learn about such additional exceptions. This way, you can avoid unnecessary complications later.For this, ensure to go through the insurance policy documents carefully. Study all the clauses listed in the policy to understand the insurers' terms and conditions. You can take the help of your legal advisor if you fail to understand certain insurance jargons. An even better approach is going through the glossary section on your selected insurers' website for easy understanding. You can also use customer service to settle your queries. Go through these steps to attain complete clarity before signing on the dotted lines.

Facts to note about non-payable items in health insurance

Here are some important points you should note about non-payable items in health insurance for maximum clarity:- All the non-medical expenses in health insurance, under the IRDAI guidelines and additional exclusions by the insurance company, are incurred out of your pocket.

- You can find the IRDAI specified non-medical expenses under medical insurance listed in any health insurance policy paper.

- You can reduce your deductibles by knowing the non-medical charges under your health insurance plan. It helps you understand the excluded expenses so you can make a wise decision while spending money on such items.

- Some insurers offer an additional cover that provides financial assistance for non-medical expenses in health insurance. Check with your insurer while buying the policy to be sure. However, do note that opting for such cover adds to your overall premium cost.

Tips to pay off the excluded non-medical expenses in health insurance

Ideally, controlling expenditure on items excluded under your health insurance coverage is best. But despite your best efforts, you may struggle to avoid such out-of-pocket expenses entirely. So, you need to strategise for managing them to reduce the financial burden. Here are some tips to help:- Shop around for offers on urgent medical supplies.

- Create an emergency medical fund despite the health insurance coverage.

- Avoid the emergency care unit except for life-threatening diseases.

- Go through your medical bills carefully to detect errors.

- Hospitalisation can incur non-medical costs when you choose an advanced room. Hence, keep it generic and go for standard services to save on out-of-pocket expenses.

- Ask for less expensive medications after talking to your doctor.

- Go to network hospitals to settle expenses as insurers have tie-ups with such hospitals, resulting in special discounts.

- Use non-hospital diagnostic centres that offer lower rates.

- Check out plans that cover out-patient department (OPD), day-care, daily cash, and higher sub-limits.

- Use discounts available on online bookings and hospital apps.

Final Note

You get all the information you need about the health insurance policy on the insurers' website. They include crucial details about the insurance terms for your perusal. Getting acquainted with such information helps you understand all the benefits and exclusions. The same goes for non-payable items in health insurance. Ensure you go through them while you buy medical insurance online. Double-check for other details in the policy papers and contact your insurer for more clarity if required.Non-medical expenses may seem daunting as they are not covered under your medical plan. But they are mostly less expensive. Also, you cannot avoid them as they are a significant part of hospitalisation. Therefore, the best way to deal with such expenses is to understand the coverage under the plan and set aside funds to pitch in accordingly. It is always good to arrange a specific portion of your savings as a medical emergency fund. This serves as a backup for additional costs. It also prevents unnecessary hassle when dealing with treatment, room rent, and other planned and unplanned hospitalisation charges.