Health insurance is a financial apparatus used by many families to navigate the uncertainty of their future. In order to benefit from the long-term investment in a mediclaim plan, people should be aware of how to fill mediclaim form and raise a claim request.

This page contains a simple guide on how to fill health insurance claim form accurately and get the benefits of high claim settlement ratios (CSR) championed by insurance companies.

What is a mediclaim form?

Before knowing how to fill health insurance claim form, it is important to understand what a mediclaim form is to avoid making any mistakes that raise the chance of a claim getting rejected. Filling a mediclaim form is a mandatory step in filing for a claim.A mediclaim form is similar to a cover letter for a college application. Basically, it contains a summary of the claim application including personal details, claim amount, and hospitalisation details. Generally, there are two parts of the mediclaim form—one part for the insured to fill out, and the other to be completed by the hospital. Health insurance providers tally the information filled in both parts to assess an application and proceed further only when both details match.

It is important to note that filling a mediclaim form comes with a set timeline (defined by the insurer); people are required to fill the claim form within 15 days of being discharged from a hospital. Some insurance companies require an additional form—preauthorisation form—to process a claim request.

Types of mediclaim

There are two types of claim requests a person with medical insurance can raise.Cashless claim

Many health insurance providers nowadays have a network of hospitals spread over the country through which they offer people a benefit of availing medical treatments without paying anything (or a nominal amount). This process simply removes the insured out of the claim process—insurance companies directly settle the claim with hospitals.

When a person chooses to receive a medical treatment at a network hospital for pre-planned procedures, they have to inform the health insurance company by filling out a pre-authorisation form about 3–5 days prior to the treatment. In case of emergency treatments, insured or family members of the insured, on their behalf, can fill out the pre-authorisation form within 24 hours for notifying the health insurance company about the emergency. In addition, the hospital will demand your health-card (issued by the insurance company) for verification before proceeding.

Reimbursement claim

As a conventional approach for claiming medical insurance, the process of reimbursement claims can be a little confusing for some people. In this process, the insured person is required to collect and share all the information in a particular manner; seemingly minuscule errors might end up as the reason for rejected claims.

People have to pay medical expenses up front at any hospital of their choice (within the country) while choosing reimbursement claim process, and later, they can raise a claim request for insurance cover. This is where most people wonder—how to fill mediclaim form. Once the error-free process is complete, the refund will reflect in your bank account in a matter of few weeks.

Step-by-step guide on how to fill medical reimbursement form

Many people find themselves stuck in the process of filing a claim wondering about how to fill mediclaim form. Here’s a basic guide to fill claim form correctly and few tips to ensure claim approval from insurers.Step 1–make an intimation of claim

People are required to notify the insurance company 2 to 3 days in advance when hospitalisation is planned. In such scenarios, the insured is generally required to fill out a pre-authorisation form.

Make sure to inform the third-party administrator (TPA) or the insurer as soon as possible in case of an emergency to avoid claim rejection.

Step 2–collect and compile documents

The next step is to collect necessary documents including the claim form that is available online on the company’s website or can be obtained offline form the nearest office branch of the insurance provider. People begin to build their claim application generally after getting discharged from the hospital.

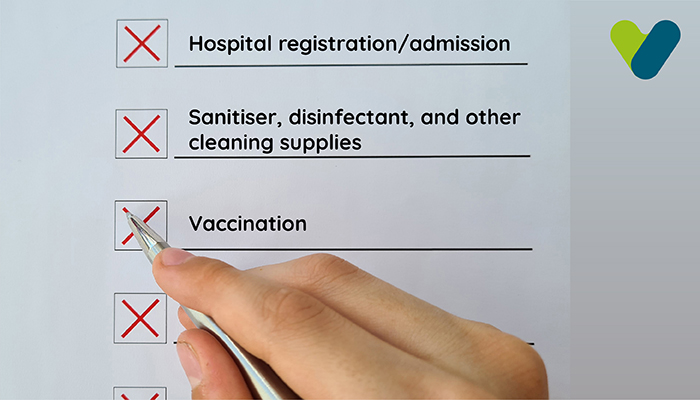

The following documents (pre-hospitalisation and in-patient department) may be required for completing the claim form:

- Health card

- Hospital registration certificate

- Duly filled claim form

- Discharge summary/certificate

- Doctor’s consultation

- Investigative and diagnostic reports

- Pharmacy invoices

- Bills of equipment if used in surgery

- Cancelled cheque or NEFT details

- FIR and/or medico-legal certificate (MCL) in case of an accident

- Fitness certificate

- All other required documents mentioned in the claim form

It is important to check the validity of a health insurance plan during this stage to know the claimable amount. Get multiple copies of the claim form in case of any errors. Start filling details in the claim form one by one. Compile all the medical reports and invoices in a chronological order in a file or manila folder for ease.

Step 3—fill in details in medical insurance claim form

As mentioned earlier, health insurance claim forms consist of two parts; the insured needs to fill part A. Following steps can help one fill such a part:

- Enter primary details including name of the policy holder, policy number, phone number, email address, and residential address.

- Declare the medical history and details of hospitalisation along with previous records of insurance coverage.

- Ensure the information entered is correct.

- Pre-hospitalisation expenses

- In-patient department (IPD) expenses

- Post-hospitalisation expenses

Step 4–make copies

The next step is to make a minimum of two copies of the filled claim form and all other documents. One copy along with the original will be sent to the health insurance company, which requires both the original documents and a copy of these original documents to proceed with the claim request. Insurers, usually, do not accept only copies of original documents.

The second copy is a backup, just in case the documents are lost.

Step 5–review and submit the claim

The final step is to cross-check the list of documents for any errors, missing documents, and accuracy. Review the details provided in the claim form, and attach all the required documents to validate the claim request. It is better to review the documents twice, just in case any error was not identified the first sweep.

Send in the complete set of documents to the health insurance company or connect with the TPA for the verification and processing of the claim. Some insurance providers also allow people to file online claims, in which the process is somewhat similar; the only change is that one has to scan and upload each document and fill the form online on the company’s website.

Things to keep in mind while filing claim

To make the best use of a brilliant financial tool—health insurance—it is important to file a claim in the required manner to increase the chances of claim approval.- Regularly check health insurance validity

- Invest some time to read policy related documents

- Be aware about the possibility of claim rejection

As soon as the insurance providers have made a decision, the same will be conveyed to the policyholder via post or mail.

Final word

One can never be certain of a healthy future; a single medical emergency can wipe out a family’s savings of a lifetime. As the medical treatment costs are increasing countrywide, a health insurance seems more like a necessity than a luxury.In order to avail of the benefits of a health insurance policy, one must be aware of how to fill mediclaim form when filing a claim. Read all policy documents carefully to understand the process and try to follow them diligently to minimize the risk of claim rejection.