After looking at multiple categories of health insurance, people often end up comparing the difference between individual and floater policies. Since the decision of choosing one plan over another (even if it is an individual insurance policy) will likely affect a family’s finances for a long time in the future, it is important to invest in the right medical insurance.

If someone wonders “which is better? family floater or individual health insurance”, the following comparison between the two plans can help them in making an informed decision.

Difference between floater and individual policy

Individual medical insurance provides coverage for one person, whereas a family/floater health insurance plan covers the entire family; this is the main difference between a floater policy and an individual policy. In addition to this, some common differences between floater and individual policies are given here:Coverage

Benefits of health insurance are shared by everyone in a family collectively in case of a floater plan, whereas individual health plans reserve all benefits only for the policyholder. The idea of family plan is similar to a television in a common area in a house, and that of an individual plan is similar to a TV set in one’s private room.Both types of plans can provide coverage for the following:

- In-patient department (IPD) hospitalisation expense cover

- Cover for pre- and post-hospitalisation charges

- Day care treatments

- Ambulance cover

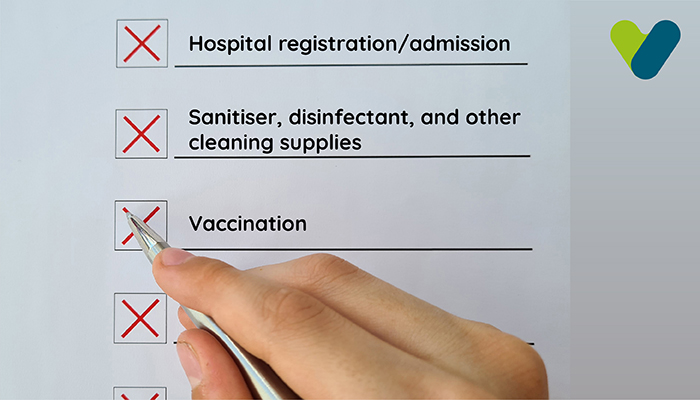

Waiting period

Insurance companies impose an initial waiting period (30–90 days) for every purchased plan; during this period, they do not entertain claim requests. Accidental covers are an exception to this rule where, a person can claim the insurance amount any day after the date of purchase.Usually, both plans have a waiting period for pre-existing diseases, but the difference between individual and floater policies is that for an individual plan, claims of only one person are denied, whereas no member of the family can raise a claim during this period in a floater plan.

Apart from this, there is a separate waiting period of 1 to 2 years for pre-existing diseases followed by some policies. This period starts from the date of purchase. With each policy, treatment coverage is provided after this waiting period is over. Make sure you understand every clause about the waiting period before finalising a plan.

Eligibility criteria

There is a minor difference between one eligibility criterion—age—of both types of policies. When comparing policy options of family floater and individual insurance to determine which is better, one should consider the age of the oldest member of the family in case of a floater policy. Health insurance providers, when calculating insurance policy premiums, consider the age factor.Benefits under the two policies

The biggest advantage of investing in an individual health insurance plan is the high coverage for one person according to their own needs and requirements. This is especially beneficial for people who have critical illness and senior citizens.On the other hand, the affordable aspect of a floater insurance plan together with coverage for the basic requirements of an entire family is quite lucrative. Ideal for families on a tight budget and/or without major health problems, family floater offers a one-and-done premium payment option. For example, an individual health insurance plan for a 30–35-year-old with a coverage of INR 5 lakhs can have a premium of around INR 12,500; the same coverage for an entire family may be availed at an approximate premium of INR 10,500.

Cons under the two policies

It is a possibility that the sum assured in case of a family plan may not be enough to cover all the medical expenses of a family, which is a major disadvantage. By contrast, an individual policyholder may not be able to fully utilise the coverage; they won’t be eligible for a no-claim bonus in a year if they claim a small amount during the time period.In addition, multiple insurance providers take the age of children into account while issuing family insurance plans. When children cross the adult age bar (usually 18–25 years) set by an insurer, they can no longer be covered under the same family plan and may have to invest in an individual plan for themselves. Some companies may waive off the waiting period if the children transition into individual plans from the same company that issued their family plan.

Individual vs floater insurance—which one should you buy?

The answer to—which is better family floater or individual insurance—is something a person has to figure out on for themselves after carefully considering every parameter and their requirements. Some families, which don’t require claims very often, may prefer a comprehensive plan for everyone, while another family with people who have severe ailments or disabilities may benefit from purchasing individual plans customised as per the needs of different family members.The limited coverage provided by a family policy may not be sufficient for a family throughout their lives; hence, they may invest additionally in individual plans for those members who require extra coverage.

Consider the following factors while making the final decision for individual vs family insurance:

- Marital status and future plans

- Evolving requirements over the future

- Age

Things to know before purchasing a health insurance plan

After considering the difference between family floater and individual insurance plans, one may decide which type of policy to go for; however, there are still a number of policies to review for the chosen category before locking in the most suitable one.The following are some additional parameters that can help people decide which policy to buy:

- Comparing different options online

- Claim settlement ratio (CSR)

- Ideal amount of sum assured

Final word

There are numerous benefits of investing in a mediclaim insurance, including peace of mind, secured savings, and availability of quality healthcare treatment. People often find themselves pondering over the choice of family floater and individual health insurance while looking for suitable policy plans. Having a family health insurance can be more beneficial if the family has little children, but if a family member has a chronic illness, individual insurance is a better choice in the long run.As mentioned earlier, do not just consider low premium rates, consider multiple scenarios and important factors that make a health insurance worthwhile.