Motherhood is a memorable experience in a woman's life. As an expectant mother, financial planning is essential to go through this phase smoothly. A maternity insurance policy assists you with the same. You can invest in it when you think of starting a family and reap the coverage benefits during pregnancy. The policy takes care of a wide range of expenses like the cost of delivery, hospitalisation, medical tests, medicines, pre-and-post-natal care, new-born baby's vaccination, etc. If you need emergency care, the policy covers the charge of ambulance services as well.

Besides covering the delivery costs, maternity health insurance companies also cover the costs associated with pregnancy-related complications and premature deliveries. The coverage is based on policy type and NICU expenses. It gives expectant mothers the option to choose between normal and Caesarean-section deliveries. Such all-encompassing coverage and value-added benefits help make your pregnancy journey smooth.

Coverage in Maternity Health Insurance Plan

Most health insurance companies offer maternity benefits as an additional feature with a regular health insurance plan. However, some Maternity health insurance companies have started offering standalone maternity insurance plans in the past few years. You can choose your preferred option based on your needs and affordability.Maternity health insurance companies typically cover the following medical expenses.

Pre and Post-hospitalisation Costs

All expenses incurred before getting hospitalised and after discharge come under the ambit of maternity insurance. You can claim coverage for medical tests, doctor's consultations, medicines, ambulance charges, etc., incurred before going into labour. In addition, insurers bear the costs associated with post-partum recovery under the post-hospitalisation coverage provided in maternity plans.Delivery Costs

The most significant cost covered by insurers under maternity plans is the delivery cost. Insurers offer financial assistance to cover all the costs of delivery in case of both normal and/or C-section deliveries. Sometimes doctors may recommend a c-section after a mother is already in the process of a normal delivery. In such cases, the hospital may levy charges for both, and the insurer covers the cost of the same.Room Rent

You typically need to stay in the hospital for at least 2 or 3 days after your child's birth, and you need to rent a room during your stay. Generally, most insurers set a sub-limit on the room rent. But some of them cover the room rent costs without any limit or cap on the amount t. This feature allows you to choose a room with advanced facilities without worrying about the sub-limit.Treatment of Pregnancy Complications

If you face complications during your pregnancy, you may need to undergo treatments to rectify the problems. You can claim the cost of such treatments under maternity coverage.Medically Necessary Pregnancy Termination

If the doctor recommends terminating your pregnancy due to pregnancy complications, your insurer covers the cost of the termination. However, insurers do not offer coverage for pregnancy terminations if the mother's health is not impacted.New-born baby cover

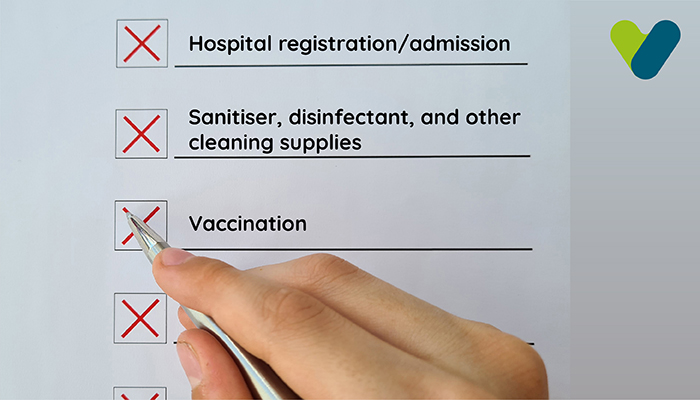

Besides childbirth, maternity insurance helps you deal with the post-natal expenses that come with a baby's birth. You can use this cover for up to 90 days after delivery to handle your baby's medical treatments. You can also utilise the new-born cover to bear vaccination and other neo-natal expenses in the first year of the baby's birth.Exclusions in Maternity Health Insurance

Here are some standard exclusions in maternity insurance policiesEctopic Pregnancy

When the pregnancy occurs outside of the uterus, you undergo a delivery through tubal surgery. Most insurers do not offer maternity coverage for the same.Cost of Supplements

You may need to consume tonic, additional nutrients, and supplements to improve your well-being during the pregnancy. The insurer, however, is not liable to cover the costs of the same.Premature Claims

Maternity coverage becomes active only after completion of the waiting period, which can range from nine months to two years. The insurer is not liable to accept any claims filed before you ride out the waiting period.IVF treatment

Most insurers do not cover the cost of in vitro fertilisation treatments mothers undergo to conceive a baby. However, you can still encash the policy to deliver babies conceived via IVF under your maternity insurance plan.Note: The coverage and exclusions are subject to variation from insurer to insurer based on their policies. Hence, checking the inclusions and exclusions clause is better before purchasing a maternity cover policy.

Importance of Picking the Best Maternity Health Insurance Company

Here's why you need to choose the best health insurance company for maternity coverageCovers High Delivery Costs

Delivery costs have increased over the years due to modern technology and equipment use. Some of the best insurance companies understand this and offer higher coverage for meeting maternity expenses.Stress-free Pregnancy

Maternity insurance companies take away the emotional and financial stress with their holistic features that address the pre and post-natal expenses. Also, the easy buying procedure and claim settlement process allow you to enjoy a stress-free pregnancy.Preparation for Complications

Pregnancy may not be a blissful experience for every woman. For some, it can be incredibly complicated and difficult. Insurers address this uncertainty under maternity cover, which covers the costs of pregnancy complications.Trusted Assistance

When you pick the best insurance company, you can rely on its prompt service in case of emergencies. Whether you have a query, complaint, or concern, you can reach out knowing that you will get efficient customer service and support. This support also proves valuable while raising claims.Transparency

The best maternity insurance companies are those that maintain complete transparency in all aspects. They lay out all the necessary information related to the policy. Hence, there is no chance of confusion while buying or raising claims against your insurance policy.

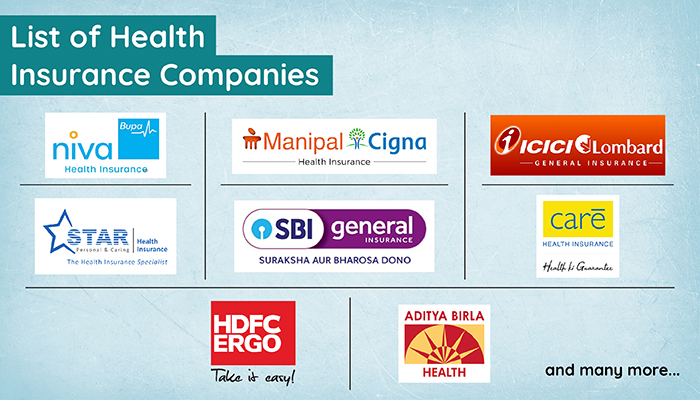

Best Maternity Health Insurance Companies in India

Niva Bupa Health Insurance

With the efficient service of settling cashless claims within 30 minutes, Niva Bupa Health Insurance (formerly Max Bupa) has become a trusted health insurance company. It has a strong network of 8600+ hospitals. For pregnancy-related expenses, it offers Health Premia, a comprehensive family-floater plan. Under this policy, you can claim maternity benefits of ₹60,000 to ₹2 lakhs based on the coverage type you choose between silver, gold, and platinum plan options. This amount covers maternity and new-born expenses for a maximum of two deliveries after a two-year waiting period.Tata AIG General Insurance

Tata AIG General Insurance has grown exponentially since its inception over 20 years ago. The company offers a broad portfolio of insurance plans, including the Medicare Premier plan with maternity benefits. With this health insurance product, TATA AIG provides cashless hospitalisation with a network of 7,200+ hospitals, substantial cumulative bonuses, 24*7 assistance, quality service, and a high settlement ratio. The Medicare Premier also celebrates female births, as is apparent with their maternity plans covering costs up to ₹50,000 for male births and ₹60,000 for female births. Additionally, you can get coverage for your new-born's first-year vaccination expenses up to ₹ 10,000 and ₹15,000 for male and female births, respectively.ICICI Lombard Health Insurance

ICICI Lombard Health Insurance Company is known for its dependable services, having settled 1.6 million claims thus far. Their vast network of 6700+ healthcare providers and customer-first approach make it one of India's best maternity health insurance companies. ICICI Lombard offers maternity benefits with Health Elite. Depending on your preference, you can choose this plan with sums insured ranging from ₹3 lakhs to ₹50 lakhs. This amount enables you to get coverage for standard hospitalisation and medical treatment expenses. You can also claim a maternity benefit of ₹15,000 to ₹25,000 on normal and ₹25,000 on Caesarean-section deliveries, respectively. Additionally, the policy offers up to ₹2,000 for post-natal expenses and a ₹10,000 to ₹1,00,000 new-born baby cover depending on the policy type.ManipalCigna Health Insurance

ManipalCigna Health Insurance offers all-encompassing insurance products to smoothen the financial blow when you face a medical emergency. You can rely on their prompt claim settlements and vast hospital network spread across 600+ cities for quick hospitalisation. If you want maternity coverage, ManipalCigna offers the ProHealth Preferred plan with sums insured ranging from ₹15 lakhs to ₹50 lakhs. For maternity benefits, you have the option to reduce the waiting period from 48 months to 24 months. After riding out the waiting period, you can claim the delivery cost, new-born baby expenses for up to 90 days, and vaccination charges for 12 months. You also enjoy value-added features like a cumulative bonus of up to 200% on the sum insured, 100% sum restoration, 20% discount on renewal premium with Healthy Reward Points, etc.Star Health Insurance

Affordability is the main focus of Star Health Insurance Company. You see this in all the products it offers for individual and family medical protection. It has a vast network of 13,000+ hospitals and a record of settling cashless claims in less than two hours. With a Star Health comprehensive insurance policy, you can benefit from this swift service during your pregnancy. As the name suggests, this plan provides holistic coverage. You should invest in it to cover maternity expenses and new-born treatment costs. You can also claim the rent of a private single AC delivery room as there is no room rent capping. Other benefits include a 100% increase in the sum insured for claim-free renewal, 100% automatic restoration for subsequent hospitalisation, etc.Care Health Insurance

Care Health Insurance is among India's best maternity health insurance companies, offering the perfect blend of general health and maternity insurance. It has curated new-age insurance products – Joy Today and Joy Tomorrow, that specifically address pregnancy-related expenses up to ₹35,000 to ₹50,000 for ₹3 lakh sum insured. You can rely on Care Health Insurance Company's network of 19,000+ network providers and claim settlement ratio of 95.2% for a smooth claim process. You can also benefit from Care Joy Maternity Insurance features like a considerably short waiting period of nine months, new-born baby expenses coverage for up to 90 days after birth, no sub-limits or caps on hospital room rent for single private AC room, etc.Go Digit General Insurance

Go Digit General Insurance Company makes health insurance easy to access and understand with simple products, jargon-free documents, and convenient claims. You can file claims easily through an audio process that eliminates any confusion. You can opt for Go Digit Health Care Plus Policy with maternity cover for pregnancy-related expenses. Like most maternity policies, this one also covers delivery costs, pregnancy complications costs, costs of medically necessary terminations, new-born babies' and vaccination expenses up to 90 days after birth, among other things. Such comprehensive coverage is coupled with benefits like no room rent restriction, 0% co-payment, 25% higher sum insured, and sum insured restoration benefit.SBI General Insurance

SBI General Insurance is spread across 135+ locations in India and boasts 20,000+ network hospitals. Such a wide presence has enabled the company to provide prompt customer assistance and settle insurance claims smoothly. You can also customise your plan, get an instant quote through SBI General's robust website, and buy your policy effortlessly. You can opt for the Arogya Plus Policy if you want to cover pregnancy expenses. You can use the sum insured to cover maternity expenses up to the OPD limit specified in the policy after riding out a nine-month waiting period. If you want to increase your coverage, you can choose the Arogya Top-up Policy, under which you can enhance your sum insured amount from ₹1 lakh to ₹50 lakhs by paying higher premiums.Tips for Choosing the Best Maternity Health Insurance Company

Here are some tips to help you make an informed decision while choosing the best maternity insurance company:Understand Coverage Needs

Before comparing the best maternity health insurance companies based on what they offer, it is important to analyse what you want. This way, you can ensure that your maternity policy matches your requirements. Analyse your needs for hospitalisation, post-natal care, desired benefits, etc., to make the best choice.Consider Company Reputation

The best health insurance company for maternity is the one that has a good reputation for customer service and accessibility, especially when you need help during emergencies. You may find several offers, but the key is to check if they can back you up on the promise. You can assess the service quality through customer reviews and testimonials.Check Network Hospitals

Insurance companies settle your maternity claims through reimbursement and cashless facilities. A cashless claim settlement is a better option if you want to get through the claim process without cash payments smoothly. For this, you should check the number of network hospitals the insurer has in your area.Compare Value-added Features

Besides the standard maternity coverage, medical insurance companies include additional features to provide better value. Such benefits may include no-sub limits on room rent, sum insured restoration, discount on premium, etc. You can consider these features as a point of comparison.Examine the Claim Settlement Ratio

The Insurance Regulatory and Development Authority of India (IRDAI) provides information about the claim settlement ratios of all Indian insurance companies on its website. The ratio indicates the company's record for settling the number of claims against the received requests. You can use this information to compare an insurer's efficiency.Step-by-Step Process to Buy Maternity Health Insurance

Follow these simple steps to buy a maternity health insurance policy online.- Compare the maternity insurance companies and choose the best one suiting your needs and budget.

- Visit the chosen insurance company's official website or download their app.

- Go to the health insurance products section and choose a plan with maternity coverage.

- Click on the 'Buy Policy' tab after making the selection.

- Determine the required sum insured to obtain a quick premium quote.

- After shortlisting the policy, you can fill in the essential details and submit the required documents.

- Once done, you can pay your premiums online through a debit card, credit card, or internet banking.

- The insurance company processes your policy and e-mails you a soft copy of your policy documents. You can also request a hard copy, which the insurer may send via post.