Cancer is a leading cause of death worldwide. According to World Health Organization, cancer claimed the lives of approximately 10 million people in 2020. The knowledge of such information can make you ponder over some difficult questions like ‘what would I do if, god forbid, I or someone in my family is diagnosed with cancer’? A cancer health insurance plan makes it easy for you to find answers, and more importantly, solutions to such a question. You will get all the information related to the best cancer health insurance plans here.

What is cancer insurance?

A cancer insurance plan is a policy specifically curated to financially aid you against any and every expense that may arise from cancer. You can avail the benefits of the best health insurance for cancer patients with this plan once you buy it after the completion of the free look up period, which is specified in the terms and conditions of your policy document. Any one of the best cancer insurance plans available in the market can provide cover for the expenses of cancer treatments, such as chemotherapy, radiation therapy, hospitalization, invasive and non-invasive surgical procedures, and even general physician consultation.

If your family has a history of cancer and you are a cancer insurance plan holder, this plan frees you up from any financial burden and stress, which you may face, related to cancer and its treatment. Such a plan lets you stay happy and free of worry by ensuring that any expenses that you may incur due to cancer will paid for by your insurance provider.

How to choose the best health insurance for cancer patients?

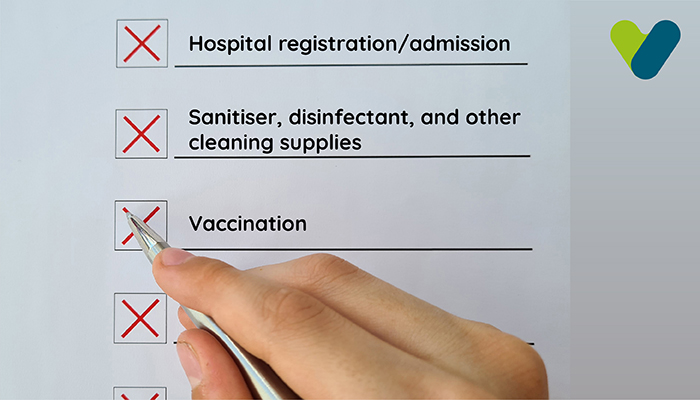

If you have a family history of cancer, you should secure yourself and your finances with a cancer insurance plan. To choose the best insurance for cancer patients, you can review the inclusions and exclusions of a cancer health policy. You should opt for the plan that provides maximum coverage for your premiums along with the most inclusions.Some common conditions that are not covered under cancer insurance plans are listed here:

- Cancer caused by pre-existing and congenital conditions

- Cancer caused by nuclear, biological, or chemical contamination

- Carcinoma of the urinary bladder

- Papillary microcarcinoma with a diameter of less than 1 cm

- Chronic lymphocytic leukaemia with the RAI stage of less than 3

- Any type of cancer resulting from AIDS, HIV, or sexually transmitted diseases

Features of cancer insurance

The best cancer insurance plan offers you numerous benefits. Some features of a cancer insurance plan are listed here:- Some cancer insurance plans waive off the policy premiums when you are diagnosed with cancer irrespective of the cancer sage.

- Some of the best cancer insurance plans provide an annual increment in the insured sum for every year during which you do not raise a claim. The amount or percentage of this increase is determined according to the terms and conditions of your policy.

- Most of the best health insurance for cancer patients pay a lump-sum amount on diagnose of this condition. You are free to use this amount in any way deemed fit by you for treatments, such as chemotherapy and radiotherapy, and/or consultation with a specialist.

- With the best insurance for cancer patients, you can also opt to receive a fixed amount every month. This type of payout may depend on the stage and severity of the condition as per the terms and conditions of your policy. You can use this amount to replace your income if needed.

- Most cancer insurance plans provide cover for the multiple stages of cancer.

- For some of the best cancer insurance plans, coverage does not stop when you are diagnosed with cancer. This implies that your cancer-related expenses can be covered throughout your life.

Types of cancer covered for under a cancer policy

Here is a list of some of the types of cancer covered under cancer health insurance:- Breast cancer

- Lung cancer

- Stomach cancer

- Ovarian cancer

- Prostate cancer

- Hypolarynx cancer

- Cervical cancer

- Endometrial cancer

- Specific cancer types covered for women

- Cervical cancer

- Endometrial cancer

- Ovarian cancer

- Specific cancer types covered for men

- Colorectal cancer

- Prostate cancer

- Lung cancer

Things to consider for choosing the best health insurance for cancer patients

You must take the following factors into account before finalizing the best insurance for cancer patients:

Family history: If you have a family history of cancer, you should get a cancer insurance plan as you may be highly prone to the condition due to your and your family’s genetic makeup.

Personal finances: You should also consider buying a cancer insurance plan when you are concerned about finance management in a case that you encounter with an unwanted and unforeseen occurrence of cancer.

Personal health: If you have been exposed to an environment with radiation due to some unavoidable reason, you should consider purchasing a cancer insurance plan. Two policies do not cover for the same disease or condition: If you have a cancer insurance plan in addition to a health insurance policy, you cannot raise a claim for the coverage of the same treatment through both these plans. The ‘coordination of benefits’ clause followed by most insurance policies ensures that the cost covered by one plan cannot be covered by the other.