It is extremely important to know the correct procedure of filing for a claim in order to increase the chances of receiving claim approval from an insurer. This post is a guide that takes you through the process of making different claims and important factors related to this process, such as claim settlement rate, that people should know about.

Please note that the procedures mentioned in this post are followed by most insurance providers; however, people can easily find more details about these processes under the section ‘how to claim health insurance’ in their policy documents.

- Claim settlement options and their process

- Cashless claim

Most insurers have created a network of hospitals/clinics in different locations to aid their customers with the medical treatment and the claim procedure. Some insurance providers have a field doctor in these hospitals to assist the insured. People can avail treatment at any of these network hospitals without paying for any medical expense.

This feature is gaining popularity because of the simplicity it brings to the whole process of hospitalisation, including bill settlement. However, people may need to pay an inconsiderable amount, depending on their plan.

How to claim cashless health insurance?

Step 1: In case of a planned medical treatment, inform the insurance company 3–5 days in advance by filling out a pre-authorisation form. It is easy to obtain this form from the insurer’s website, or you can reach out to their support team.However, if there is a medical emergency you can fill out the pre-authorisation form at the hospital. Most companies demand that you fill the form within 24 hours of the medical incident to be eligible for the claim.

Step 2: Contact the reception at the network hospital and inform the concerned authority about the medical treatment and claim. They will likely show you the insurance help desk.

Present the e-health card of the insured for identification at the insurance help desk. After the hospital has verified the identity, they will submit the pre-authorisation form to the insurance company along with all the bills and receipts on the patient’s behalf.

After the second step, the insured doesn’t really have to do anything. The health insurance company will review the claim against the terms and conditions of the policy on receiving the documents from the hospital.

If everything is right, the insurer then settles the claim with the hospital and sends out a notification to the insured with information about this settlement.

- Reimbursement claim

This claim can also be raised for medical treatments at a hospital that are not a part of the insurer’s network, if the insurance company offers cashless settlements.

How to claim medical reimbursement?

Step 1: Inform the health insurance company as soon as you have knowledge about medical treatments that you will be raising a claim for. The timeline here is similar to the cashless settlement process. Inform the insurer 2–3 days in advance when you are availing a planed treatment. In case of emergencies, you should inform the company within 24 hours of the incident.Step 2: The next step is to build your application. After completing the treatment, collect the discharge certificate/summary from the hospital along with all the receipts and reports. The hospital has to validate every original document by stamping it.

Step 3: Once all the supporting documents are ready, the next step is to fill the claim form as per the instructions. It is easy to obtain the claim form from the agent or download it from the website.

Attach all the original documents along with the duly-filled claim form, and courier it to the insurance company. It is best to scan the documents, create a PDF, and share everything through an e-mail to the insurance company as well.

Upon considering and verifying the integrity of the claim, the insurance company reimburses the sum after some deductions. The process usually takes a few weeks.

Few insurance providers also demand a fitness certificate post-hospitalisation to process the claim.

- What expenses are covered with a claim?

Few options are available in the market with an adequate coverage for the treatment of diabetes, cancer, disabilities, or cardiovascular ailments. Some insurance providers offer premium health check-up packages for individuals to avail once or twice a year.

However, one should always go through the policy documents to confirm the deliverables by the insurance provider.

- Required document for settling a claim

- Health card (ID card provided by the insurance company)

- Duly filled claim form

- All documents and reports for doctor consultation

- Pharmacy invoices/receipts

- Investigative and diagnostic reports

- Discharge summary

- Bills of any equipment used in surgery

- NEFT details or a cancelled cheque

- Medico-legal certificate (MCL) and/or FIR when claiming for treatment of accidental injury

- All other required documents as requested by the insurance providers such as a fitness certificate

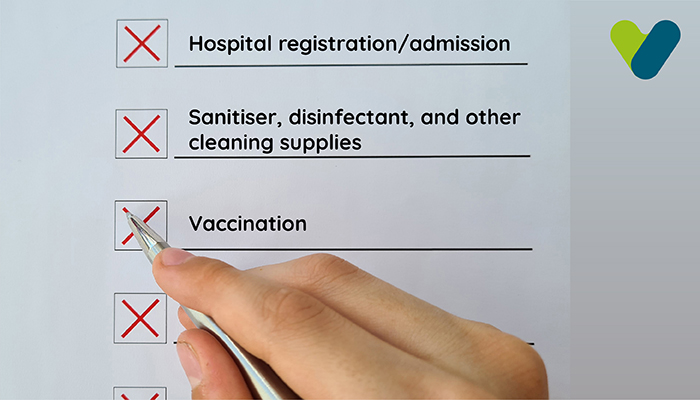

- When can an insurance company reject my claim?

- Incomplete or wrong information submitted along with the claim form

- Claim requests raised for medical expenses that are not covered in the policy

- Claim for pre-existing disease’s medical treatment during the waiting period

- Expired policy

- Insured sum is exhausted or sub-limits of the policy is reached

- Disingenuous claim request

- Claim settlement ratio

(Number of claims settled/number of claim requests received) × 100

By analysing the CSR of an insurance provider for the past few years, a person can get a clear understanding of how efficient the company is in delivering their promise. It goes without saying that higher the CSR of a company, higher the chances of the claim settlement.

Consider the following while selecting a health insurance plan:

- CSR is calculated in a comprehensive manner, which means that it includes every policy claim (motor insurance, term insurance plans, health insurance plans, and more). Hence, an insurance company’s high CSR does not translate to an equally high chance of claim settlement for every policy offered by them.

- When given almost equal choices, a person should always go for the policy from the insurance company with the highest CSR. There is no point in buying a low premium health plan today and incur losses in the form of claim rejection in the future.

Before anything, reading policy documents carefully is a must to understand the terms and conditions of the health insurance plan.

Here is a list of some important pointers that one should bear in mind during the process of raising an insurance claim for settlement:

A claim request should be made within 24 hours of getting an emergency medical treatment. However, it is best to inform the insurance provider with the help of a pre-authorisation form 2–4 days before a planned procedure.

Some insurance companies add additional cost in the policy plan to cover the losses incurred when providing coverage for high-risk individuals. This process is known as claim loading.

Anyone with an insurance policy can raise a claim settlement request on their own if they are healthy enough to perform all the procedures by themselves.

Here is a list of some of the documents that are mandatory to raise a claim:

- A duly filled claim form

- All the medical bills and reports

- The reports of every relevant consultation by the doctor

- Health insurance card