The possibility of contracting illnesses increases with age. If not prepared, senior citizens have to bear the inflating medical costs. Such financial pressure can get overwhelming and also affect their retirement savings. A solution to preserve your savings while getting the best medical care is investing in senior citizen health insurance plans. Such a policy is specifically designed for people aged above 60 years. If you or your parents exceed this age range, you should consider buying a senior citizen medical insurance policy to manage the unprecedented medical expenses in your old age.

The best senior citizen health insurance policy is one that offers maximum coverage against all significant medical conditions that typically impact senior citizens’ health. It should also come with a decent sum insured amount to cover the various medical costs arising from a medical diagnosis. For instance, the policy should cover the cost of hospitalisation, surgeon’s fees, ambulance charges, pre and post-hospitalisation expenses, medical tests and screenings, and annual health check-ups, among other things. You should also be able to customise your policy with additional riders.

Features & Benefits of The Best Senior Health Citizen Insurance Plans

When looking for the best policy for senior citizens, check for these salient features:Targeted Coverage

As senior citizens, you may have specific health concerns for which you may require coverage. Insurers may typically not offer this type of coverage with standard health plans. However, a Senior citizen health insurance plan can help bridge this gap. Such a plan focuses on areas such as domiciliary care, critical illness coverage, day-care charges, and more. Some plans also cover alternative treatments and procedures to help you seek non-allopathic treatments under the AYUSH (Ayurveda, Yoga and Naturopathy, Unani, Siddha, and Homeopathy) vertical.

Free Health Check-up

Early detection is essential to stop ailments from turning into severe threats. For this, regular check-ups are necessary. The insurance company typically assesses your medical history to understand your health condition and determine the premium. Hence, insurers conduct an annual medical check-up during the policy renewal period. They consider your changing health conditions to determine the appropriate premium amount for the following policy year.

Lifetime renewability

General health insurance plans come with an age limit, which means you cannot renew the policy after a certain age. One of the beneficial features of the best senior citizen health insurance policy is that it eliminates this age limit constraint. Insurers today include the lifelong renewability clause in senior citizen plans that prevents the hassle of re-qualifying for new medical insurance after growing old. With this benefit, you can enjoy your chosen health coverage under a senior citizen health policy for life.

Customisability

Insurers enable you to personalise or customise the senior health insurance plan based on your needs. While they may devise the base plan to include or exclude certain aspects of coverage, they provision of additional riders enables customisation. You can thus personalise your plan by choosing various riders to meet your specific healthcare needs. However, the addition of riders to your policy attracts a higher premium. You must thus perform a cost-benefit analysis to make the right selection.

No Claims Bonus

If you successfully complete the policy period without raising claims, the insurance company rewards you with a no claim bonus. Insurers offer the no claims bonus either as a discount on the premium amount or enhance your policy’s sum insured. In either case, the bonus is offered progressively over a period of 5 years, wherein you can get up to 50% discount (10% for each claim-free year), or a 50% enhanced sum insured.

Tax Saving Benefits

The best senior citizen health insurance plan comes with tax benefits on crucial investments like insurance. The Government of India offers annual tax deductions of up to ₹50,000 on senior citizen health insurance policies under section 80D of the Income Tax Act, 1961. Such a benefit also includes a tax rebate of ₹5000 on preventive health check-ups. However, these benefits may be claimed only by individuals purchasing the senior citizen policies. Thus, individuals under 60 years purchasing health insurance for their parents may claim annual tax deductions of ₹75,000 (₹25,000 for self, spouse, and children, and ₹50,000 for parents). Additionally, senior citizens purchasing insurance for their parents can claim up to ₹100,000 in tax deduction benefits.

Best Medical Insurance for Senior Citizens – Inclusions and Exclusions

The best health insurance plans come with a standard coverage structure with inclusions and exclusions as follows:Inclusions:

- In-patient hospitalisation costs like medicines, room rent, ICU charges, doctor fees, etc.

- Pre-and post-hospitalisation expenses

- Cost of domiciliary care

- Modern procedures

- AYUSH treatment

- Day-care procedures

- Organ donor expenses

- Ambulance charges

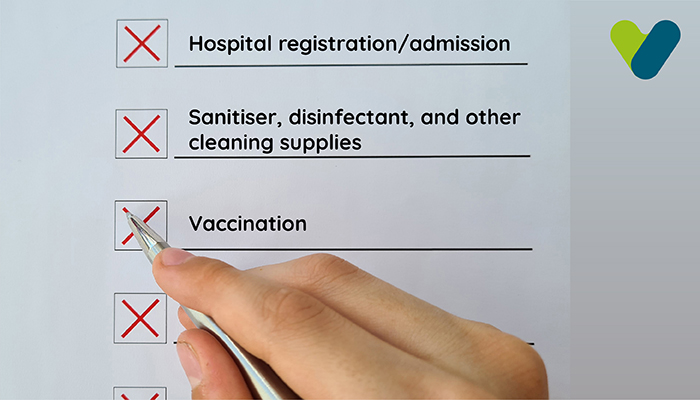

- Self-imposed injuries

- Adventure sport-related accidents

- HIV/AIDS treatment

- Dental treatments unless due to accidental injury

- Expenses for treating alcohol or drug addiction

- Injuries resulting from war, terrorist activities, strife, etc.

- Recreational cosmetic surgeries

How to Determine the Ideal Coverage for Senior Citizen Health Plans?

Consider these factors while choosing the best senior citizen health insurance plans.- Health Concerns

- Medical History

- Desired Premium

- Geographical Location

Best Senior Citizen Health Insurance Policies Available in India

The best health policy for senior citizens is one that provides maximum coverage while being affordable. Here are some policies worth considering.- Health Suraksha Platinum Smart Plan by HDFC Ergo

- Care Senior by Care

- ReAssure by NIBH

- Activ Health Platinum Enhanced by Aditya Birla Health insurance

Tips for Picking the Best Senior Citizen Health Insurance Policies

Follow the below tips while choosing the best senior citizen policy among the many choices available in India- Identify Coverage Needs

- Compare Providers

- Examine Claim Settlement ratios

- Check Network Hospitals

- Understand co-payment

- Look into critical illness benefits

Purchasing the Best Medical Insurance For Senior Citizens – The Steps

Most insurance companies have made it convenient to buy senior citizen policies online. You can visit their official website and follow these steps.- Locate the ‘Senior Citizen Health Policy’ on your chosen insurer’s website.

- Enter your personal details like your age, name, location, contact information, etc.

- You will get a tentative insurance quote stating the sum insured and possible premium amount.

- If you are satisfied with the quote, you can go to the next section and fill in the essential details in the declaration form.

- Now upload the digital copies of the required documents for verification.

- Pay the applicable premium via NetBanking or Mobile Banking.

- Once your payment is processed, the insurer verifies your details.

- If everything is correct, you will receive the policy documents in your email within a few hours. You can take a printout of the same for future reference.