During motherhood, you go through various stages of memorable experiences. The last thing you want is the thought of medical expenses to prevent you from enjoying this beautiful phase. Maternity insurance eliminates this concern. It takes care of the medical costs associated with childbirth and post-natal care. You can invest in maternity health insurance before you plan to start your family as a proactive measure to secure your finances during pregnancy and childbirth.

With the solid support of maternity insurance benefits, you can manage the costs associated with delivery, whether normal or caesarean, smoothly. The best insurance plan for pregnancy combats inflating hospitalisation costs and lets you put your savings to better use for your new-born’s future. The key is to consider your individual health concerns, coverage needs, and budget, and make the right choice while buying your maternity insurance policy.

Features & Benefits of Medical Insurance for Pregnancy

Look out for these salient features and benefits while purchasing health insurance for pregnancy plans:- Extensive Maternity Cover

- Easy Buying Process

- Coverage for Modern Procedures

- Seamless Claim Settlement

- Emergency Assistance

Coverage and Exceptions in Health Insurance for Pregnancy

Some of the standard medical expenses included and excluded from maternity insurance coverage are as follows.Inclusions

- Delivery Cost

- Hospitalisation Expenses

- New-born Coverage

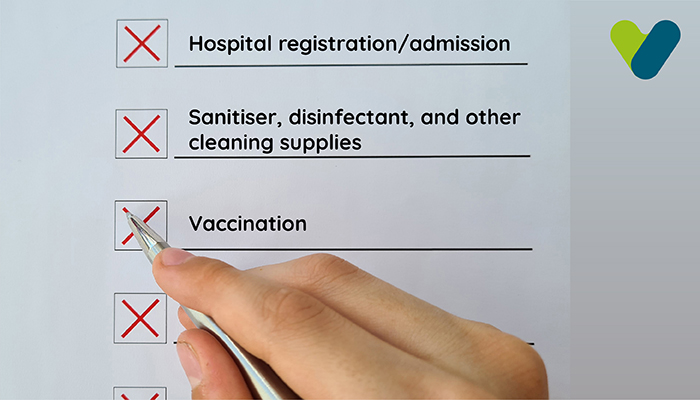

Exclusions

- Cost of Supplements

- Premature Pregnancy Termination

- In-vitro Fertilisation

Eligibility Criteria and Documentation for Buying Maternity Health Insurance

Age is the primary factor that influences your eligibility for buying a maternity insurance policy. The minimum entry age is 18 to 24 years, and the exit age is 45 years. The exact parameter differs from one insurer to another. You must prove your eligibility by submitting ID and address proof documents including your birth certificate, PAN card, Aadhaar Card, Voter's ID, or Driver's License. Additionally, you need to submit a health report if the insurer requests it.Best Maternity Insurance Plans

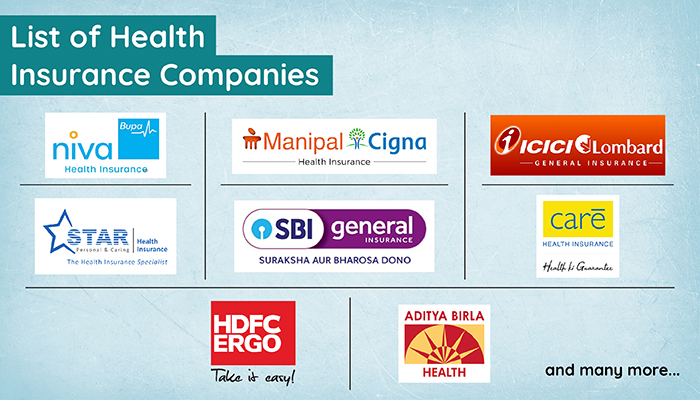

Consider this list to find the best insurance plan for pregnancy if you are planning to start a family.- Health Premia by Niva Bupa Health Insurance

- Medicare Premier by TATA AIG

- Pro Health Preferred by ManipalCigna

- Health Elite by ICICI Lombard

- Comprehensive Policy by Star Health

- Care Joy by Care

- Digit Health Care Plus Policy by Go Digit

- Arogya Plus by SBI General Insurance

Aspects to Consider While Shortlisting the Best Health Insurance for Pregnancy

You must take into account these critical factors while choosing the best health insurance policy for pregnancy.- Premium and Sum Insured

- Waiting Period

- Sub-limits

- Special Coverage Benefits

- Network Hospitals