It is natural to be concerned about your family’s well-being and look for ways to secure their future. Investing in family medical insurance plans is one way of making sure that you and your family are well-equipped to deal with potential medical emergencies.

Health insurance is a brilliant financial tool that provides a safety net for the policyholder to fall back on. People can actually focus on getting optimum medical care for themselves without fretting over their finances when they have a health insurance plan. Having a family health insurance makes the deal even better as you can enjoy coverage for the entire family under one plan at lower premium rates than the premium cost of individual health insurance.

Read on to discover family health insurance companies for you and your family.

List of some of the best family health insurance companies with few examples

There are numerous insurance providers in the market today, but some of them have a long-standing reputation and/or excellent products and services. Here are some of the leaders of health insurance in Indian market today:- HDFC Ergo

Health Suraksha and Optima Restore are two examples of family medical insurance plans offered by HDFC Ergo. Although Health Suraksha plan does not cover the treatment cost for obesity or cosmetic procedures, it offers cashless facility for home healthcare when your doctor recommends treatment at home. In addition, there is no room rent caps in this policy, and you receive a lump sum amount of INR 15,000 in case that a single hospitalisation period exceeds 10 days. The Optima Restore policy comes with its own merit such as 100% of base sum insured restore benefits after the first claim.

- Star Health

One of their products—Star Comprehensive Insurance Policy—is much appreciated by families as they also get cover for delivery, treatment, and vaccination of a new-born. A couple aged between 18 and 65 years can purchase this health insurance for themselves and their children (up to 3) aged between 3 months and 25 years. Besides, during hospitalisation the patient will receive a hospital cash allowance for up to 7 days. The expenses incurred during organ transplant for the insured patient are also covered under the Star Comprehensive Insurance Policy.

Star Health’s Family Health Optima Insurance Plan goes a step further and covers dependent parents as well, thus providing coverage for the entire family.

- ICICI Lombard

ICICI Lombard complete health insurance or simply known as Health shield is a comprehensive health insurance plan for families with extensive coverage starting from 3 lakhs and going up to 50 lakhs. The availability of multiple add-on covers increases the overall value of the policy. People can avail cashless hospitalisation facilities at more than 4000 network hospitals across India. The sum insured provides coverage for in-patient department (IPD), day care, and AYUSH treatment along with cataract treatment (with sub-limits depending on the policy). Although this policy has lifetime renewability, the policy premium is subject to change at the discretion of the company. On renewing the policy, you will get cumulative bonus and free health check-up coupons for any two members of your family.

- ManipalCigna

ProHealth is one of the products offered by ManipalCigna with a unique feature—there is no maximum age limit to buy the medical insurance. However, it is recommended that you invest in the policy early on to pay lower premium rates and enjoy more benefits. The minimum eligibility age for adults is 18 years, and they can include their children aged between 91 days and 23 years in the family plan. Guaranteed cumulative bonus of up to 200% of the base sum insured makes this policy even more lucrative for families. The most basic plan—ProHealth Plus—offers the coverage of as little as 2.5 lakhs, and people can also avail a cover of up to 1 crore by purchasing the ProHealth Premier plan.

- TAGIC

Tata AIG MediCare Health Insurance plan is a great choice if you are considering medical insurance for your family. Along with providing coverage for you, your spouse, and up to 3 children, this policy gives you the option of including your parents in the same coverage. TATA AIG MediCare—basic plan—is most suitable for people who are looking for budget-friendly policies, and for those who want an all-round safety net Tata AIG MediCare Premier could be the right choice.

- Aditya Birla Capital

Their Activ Assure Diamond health insurance plan is dedicated for protecting your family against medical crisis. It covers the policyholder, their spouse, and up to 3 dependent children (including legally adopted children between the age of 3 months and 25 years) for a premium of about INR 6,300. Minimum age limits for the eligibility of this pan are 91 days for dependent child and 18 years for adults; 65 years is the maximum age limit. Offering coverage for IPD treatment, day care treatment, and about 10% no-claim bonus, this plan is a good option for people to consider.

- SBIG

The company has family health insurance policies that provide cover for services including air ambulance and the treatment of cataract and bariatric surgery. Arogya Supreme and Arogya Plus are two of their prominent family medical insurance plans, both offering a wide range of benefits. Although Arogya Plus offers coverage options of INR 1/2/3 lakhs, Arogya Supreme has a wider safety net with its 3 tiers—Arogya Supreme Pro with sum insured (SI) with a range of 3–5 lakhs, Arogya Supreme Plus with 6–20 lakhs SI range, and Arogya Supreme Premium with SI starting from 25 lakhs.

Benefits of buying family health insurance

There is no denying that investing in health insurance for your family can prove to be extremely beneficial during harsh times. Here are some additional benefits that come along with many health insurance plans for families:- No-claim bonus

- Cashless claims

The claim process is also quite simple; people have to show their ID card (issued by the insurance provider) and fill a required form and that’s it.

- Free health check-ups

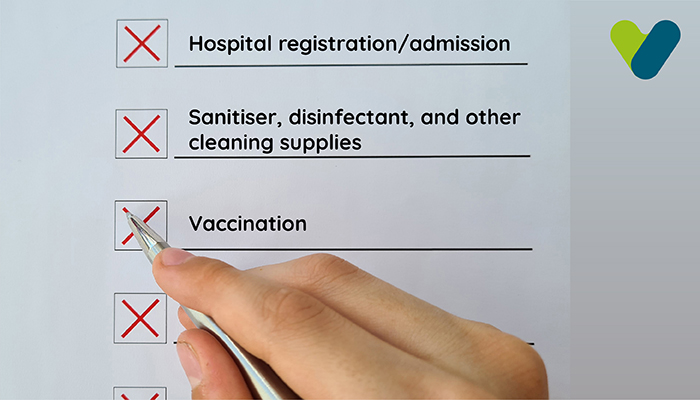

Things to consider before purchasing family medical insurance

Investing in health insurance is a long-term commitment that can affect the finances of your entire family. Ponder over the following points before deciding a final policy for your family:- Cash settlement ratio or CSR

It is best to seek out companies that have a high CSR, such as TAGIC (94.21%), from the beginning as you have a high chance of getting claims for your medical expenses with them.

- Finances

- Online comparison

- Renewability

However, it does not mean you won’t have the choice to explore other policies in the future. You can choose to abandon the previous plan and not renew it to invest in a better option.

Final word

Now that you know about the best family health insurance companies, you can easily compare their plans to choose the plan that is suitable for your family. Make sure you invest in a health insurance plan early on to enjoy low premium rates. It is also recommended that you buy an individual plan for your parents if they have any pre-existing diseases such as diabetes or cardio-vascular ailments, as including them in your family insurance plan may increase premium costs and reduce overall coverage benefits.Although most insurance providers operate in good faith, there have been instances where people were tricked by false promises or incomplete information about the policy. Before buying a plan, make sure you fully understand the terms and conditions of the policy. In addition, verify that every verbal commitment made to you is present in writing in the official documents.