While looking for a health insurance plan, you may have wondered about how are health insurance premiums calculated.

Insurance companies assess the profile of a person and potential risks according to various factors. Only after this assessment insurance providers share a premium amount to their clients, offering them desired coverage.

What is a health insurance premium?

Health insurance providers charge a fee for offering medical expense coverage to a policy holder; this fee is known as an insurance premium. People pay premiums as per the timeline specified by their insurance company in the policy documents—monthly, quarterly, annually, or full amount up front.

As most insurer’s have created a legitimate online presence, people can pay policy premiums in different ways (including online and auto-debit options). Under the Section 80D of Income Tax Act, people can also claim deductions against the health insurance policy premiums paid while filing for income tax.

Now, let’s have a look at how are health insurance premiums calculated.

Factors influencing a health insurance premium

Most health insurance companies follow standard guidelines to calculate medical insurance premiums, but the methods used by one insurer might completely differ from the calculation techniques followed by other companies. Make sure to choose a plan only after a careful consideration of all the aspects mentioned below to enjoy maximum benefits at the lowest possible premiums.-

Age

Since health insurance companies will be covering for a person’s medical expenses, they need to assess the costs involved in issuing insurance to a person. Hence, it is only natural that health insurance premium for young people is comparatively less than premium of health insurance plans for elderly.

-

Medical history and current health status

It is mandatory to disclose an individual’s medical history, as this information affects the premium amount. After analysing a person’s medical history, insurers categorise some people (who have pre-existing health conditions) as high-risk individuals. Policy premiums are generally high for high-risk individuals and people with a prominent family history of lifestyle diseases.

-

Type of coverage

While deciding ‘how to calculate medical insurance premiums’, insurer’s follow a general principle—higher the risk of providing a claim, higher the policy premium and vice-versa.

-

Assured sum

-

No claim bonus

Every year that goes without a claim request, insurance providers give a bonus to the policy holder—no claim bonus. Policies that offer no claim bonus are priced higher than basic ones.

-

Lifestyle

How and where can I calculate premium costs?

Several premium calculators are available online for the general public to obtain an estimate of the policy premium for their required coverage. A premium calculator is based on a well-designed matrix that turns an otherwise complex process of premium calculation into a piece of cake.

When a person enters simple values (such as required coverage, age, city, and other factors) as inputs, the premium calculator gives them a rough amount, which they would have to pay to get the desired policy along with different policy options matching their interest.

Most premium calculators work on a similar principle. To calculate health insurance premium cost:

- go to an online portal for premium calculation

- share basic details such as age, city, number of family members (for a floater plan), coverage required

- get a list of different policy options with the estimated premium amounts for each plan

Why should I calculate premium costs?

Several health insurance plans are now available at the click of a button. With this pool of abundant choices, a need to compare different options arises. Many people make the mistake of jumping at the first insurance policy recommended to them.

Following list shows why is it important to calculate medical insurance premiums before finalising a plan:

- Financial planning

- Ideal plan selection

How to reduce premium costs?

People often find themselves in a dilemma of whether to choose adequate coverage or to go for a policy option that is in their budget. However, there are some ways to get the best of both worlds.

One way is to consider a medical insurance with low coverage, but that might not be the best choice. Another is to choose a basic plan first and then add necessary riders to increase the assured sum. A comprehensive health insurance plan can be also opted for if you have other policies (such as life and auto insurance policies) with the same company, as insurance providers offer discounts to people if they purchase a bunch of plans from them. Some insurance companies also encourage their customers to pursue a healthy lifestyle by giving incentives for annual health check-ups and no claim bonuses. As is common knowledge, smokers are charged high premium rates compared with non-smokers. Hence, there are high chances that people can avail of low premium costs if they quit smoking.

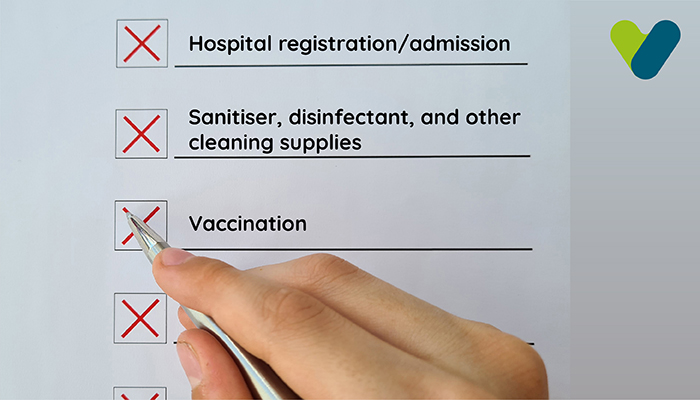

Things to consider while purchasing a health insurance policy

A right health insurance plan can act as an excellent financial tool, but investing in a policy that does not fulfil your requirements can be drastically damaging in the long run. Consider the following things before buying a medical insurance for making an informed decision:- A careful assessment of personal needs and current health status can indicate how much coverage is needed.

- Available budget and policy premium costs are important financial parameters that one must consider.

- Insurance plans that can be renewed at the same or similar price are preferred by people.

- Policies that offer cover for pre-existing diseases with minimum waiting period can make a significant difference.

- Additional benefits such as no claim bonus and free annual health check-ups make the plan considerably lucrative.

Final word

To sum it up, health insurance premium costs are based on the type of coverage, the amount of coverage, age, gender, the current location of buyers, and some other attributes. High premium costs go hand in hand with high risks for an individual. However, the tactics mentioned above can help people in reducing policy premiums. Additionally, you can avail of low premium costs if you invest in a policy plan early on.

Even though it is a tedious task, exploring different policy options definitely pays off. Make sure you read all the policy documents to understand terms and conditions.