Unexpected medical emergencies always remain a threat. The best solution to combat them is to invest in health insurance. One of the most basic types of health insurance policy is an individual health insurance policy. Such a plan protects your well-being and prevents illnesses, critical health conditions, and other medical problems from taking a toll on your well-being. You can protect your mental and physical health with the financial backing of a personal health policy.

With an individual medical insurance plan, you enjoy the benefits of extensive coverage as the policy’s sole beneficiary. You can also customise the coverage to meet your specific needs. However, such policies are not transferrable to anybody else. Only the individual named as the policyholder can seek medical attention. If you want medical protection for your family, you can buy a separate policy for each member. Several personal health insurance companies assist with the same. Choosing the best one is about knowing your needs and budget.

Features & Benefits of Individual Health insurance

Some of the salient features and benefits of individual health insurance are as follows:- Comprehensive Coverage

- Cost-Effective Investment

- Lifetime Renewability

- Tax Exemptions

- Alternative Treatments

- Individual Sum Insured

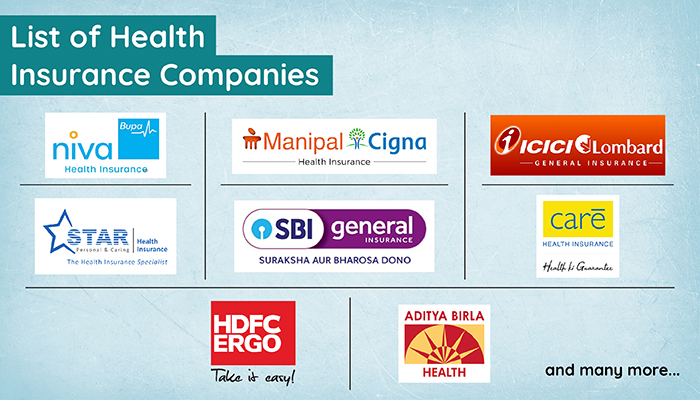

Best Personal Health Insurance Companies in India

Here is a list of the leading health insurance companies in India: Niva Bupa Health insurance (formerly Max Bupa) is a renowned insurance provider that offers a wide range of health insurance plans. With a strong network of 8600+ hospitals, 30-minute cashless claim processing, and digital solutions, it ensures your complete satisfaction. You can get all these benefits at an affordable premium. Based on your requirements, you can choose between Niva Bupa personal health insurance policies like Health Companion and ReAssure. TATA General Insurance Limited is a joint venture between Tata Group and American International Group (AIG). Since its commencement, it has grown exponentially and partnered with 7200+ hospitals across India. You can rely on TATA AIG for a smooth cashless claim settlement process. Other reliable features of TATA AIG personal health insurance are round-the-clock assistance, discounted premiums, substantial cumulative bonus, etc. For the best protection for your individual needs, TATA AIG offers MediCare, Medicare Premier, and MediCare Protect policies. ManipalCigna Health insurance secures your health during uncertain medical emergencies with its comprehensive coverage. You can opt for its fully loaded personal health policies like Pro Health Plus and Pro Health Protect. These expertly-curated health plans specifically target your healthcare needs at an affordable premium. They also ensure a quick and hassle-free claim settlement experience with a vast hospital network in over 600 cities. For individual health protection, you can opt for Manipal Cigna Pro Health Protect or Pro Health Plus, depending on your coverage requirements. Dependability, approachable customer care, and transparency make ICICI Lombard Health insurance one of the best personal health insurance companies in India. The company offers complete medical protection with its ICICI Health Shield policy, with sums insured ranging from ₹5 lakhs to ₹50 lakhs. You can enhance your cover value with the health booster feature. Additionally, you get a Befit Cover that settles OPD expenses on a cashless basis. ICICI Lombard provides immediate assistance with 24*7 support, quick claim settlement, and 6700+ healthcare providers. You can access the company’s offerings conveniently through the IL Take Care App. Owing to its good claim settlement record and affordable health plans, Star Health insurance has become a household name in India. If you want financial protection to secure your individual healthcare needs, you can buy Young Star Insurance Policy by Star Health insurance. The plan comes with exceptional benefits like automatic restoration of the sum insured, no capping on room rent, mid-term inclusion of family members, wellness programme, and loyalty discount. Besides YoungStar, Star Health insurance also offers plans like MediclassicBase that cover a wide range of expenses. If you want a higher sum insured, MediclassicGold is an ideal plan for you with its super restoration benefit of 100% and automatic restoration of 200%. SBI General Insurance lets you customise your health plan based on your health concerns. You can adjust the premium accordingly and buy affordable individual health insurance plans. To address your personal medical needs, you consider the SBI General Arogya Plus Health insurance plan. The policy comes with a flat premium rate regardless of your age and covers expenses for OPD treatments, pre-and-post hospitalisation, maternity costs, etc. You can enjoy all this and more with up to a 7.5% discount if you opt for a longer tenure policy. Care Health insurance (formerly Religare Health insurance) offers exclusive plans for varied health risks. You can benefit from its vast range of network hospitals and its high claim settlement ratio of 95.2% for hassle-free financial assistance during medical emergencies. For all-round individual medical needs, you can choose the Care Advantage plan. With a sum insured of ₹1 crore, it ensures you never have to worry about being underinsured. You also have the option to upgrade the extensive base coverage with specific add-ons like Covid Care, No Claim Bonus Super, Care Shield, Room Rent Modification, etc. HDFC Ergo is among the best personal health insurance companies in India because of its customer-first approach. Every service is centred around convenience. You experience this with their under-three-minutes policy buying experience and cashless claim settlement within 20 minutes. If you want to enjoy such convenience while seeking individual healthcare protection, consider HDFC Ergo’s Optima Restore plan that enables you to restore 100% of the sum insured. Other beneficial features include lifelong renewal, no geography-based sub-limits, smooth portability, etc. You can also enjoy up to an 8% discount on your renewal premium with Stay Active Benefit. Aditya Birla Health insurance is the health insurance company for you if you like discounted benefits with extensive coverage. The Active Health personal insurance plans by Aditya Birla are designed with features that address your healthcare needs while proving all-encompassing protection. These plans come with comprehensive health coverage and a chronic management program and provide access to expert health coaches. Depending on your sum insured requirement, you can choose between variants like Essential, Enhanced, and Premiere under Aditya Birla’s Activ Health Platinum Plans.

Eligibility Requirements for Buying Individual Medical Insurance

Most health insurance companies require you to fulfil the following eligibility criteria while buying Individual medical insurance policies.- Age

- Pre-existing Ailments

- Medical History

Documents Required for Buying Individual Health insurance

Keep these documents handy while buying your personal health policy to get through the verification process smoothly:

- Duly filled proposal form with details like your full name, age, location, contact information, etc.

- Passport size photographs

- Identity proof (Voted ID/PAN Card/Aadhaar Card/Driving License/Passport)

- Age proof (Birth certificate, Aadhaar Card, Passport, PAN Card)

- Residence proof (Aadhaar Card/Electricity bill/Landline bill/Ration Card)

- Medical Reports (If requested by the insurer).

How to File an Individual Health insurance Claim?

You can file an individual health insurance claim in two ways.

Reimbursement Claim

You need to file a reimbursement claim when you seek treatment at your preferred non-network hospital. Here, you need to pay for the treatment costs on your own and file a reimbursement claim after being discharged from the hospital. Follow these steps to file your reimbursement claim.

- Inform your insurer before seeking admission in a hospital for planned treatments or within 24 hours in case of emergency hospitalisation.

- Fill out and submit the claim form along with original medical bills and other essential documents.

- After assessing the medical expenses, the insurer verifies your claim and reimburses you up to the sum insured amount.

You can seek admission in a hospital within the insurer’s network to enjoy cashless claim settlement benefits. Simply follow these steps:

- Inform the insurer about the network hospital where you intend to seek treatment.

- Fill in the cashless claim form with the essential details concerning your medical treatment.

- Submit the claim form with the medical records to the TPA.

- After inspection, TPA provides you with a confirmation letter.

- You can furnish the confirmation letter at the hospital counter to process the cashless claim request.

Factors Worth Considering While Choosing a Health insurance Provider

Here are some essential components to check while selecting the best medical insurance company.- Coverage Benefits

- Premium Amount

- Claim Settlement Ratio

- Customer Support

- Conditional Terms