Health insurance is an investment worthy of its name. It is one of the most beneficial investments that come with a lot of perks, including medical coverage and financial security. One of the many perks of health insurance is the no-claims bonus, often abbreviated as NCB. The no-claims bonus in health insurance means a monetary reward that insurance companies provide to policyholders for not filing insurance claims.

NCB in health insurance is a financial benefit that either reduces your premium outgo or enhances your health insurance sum insured. The insurer takes into account the number of claim-free years to determine the no-claims bonus you are entitled to, and they typically offer this bonus during the first few years of the policy term.

How Does Health Insurance No Claims Bonus Work?

As a policyholder, you become entitled to a no-claims bonus when you do not file an insurance claim in a given policy year. Insurers typically provide the NCB health insurance benefit in the first five years of the policy.The insurer may reduce your insurance premium by a specific percentage, thus providing a discount on your health insurance premiums. Alternatively, the insurer may increase your sum insured by a specific amount without increasing your insurance premiums. Most health insurance providers in India typically offer enhanced sums insured instead of discounts.

Types of NCB in Health Insurance

Insurers categorise health insurance no claims bonus into two types.- The Discount Benefit

The insurer generally offers a 10% discount for every claim-free year, up to five years. Thus, by the end of the fifth year, you can get a discount of up to 50% on your insurance premiums, provided you do not file any insurance claims during the first five years of your policy period.

- The Cumulative Benefit

Insurers generally increase your sum insured amount by 10% each year for every claim-free year. To qualify for this benefit, you should not have filed medical insurance claims in the first five years of the policy period. By the end of the fifth continuous claim-free year, the insurer increases your sum insured by 50%. The enhanced sum insured provided under the cumulative NCB in health insurance benefit proves helpful as it allows for inflation-adjusted benefits.

Policies Covered Under NCB in Health Insurance

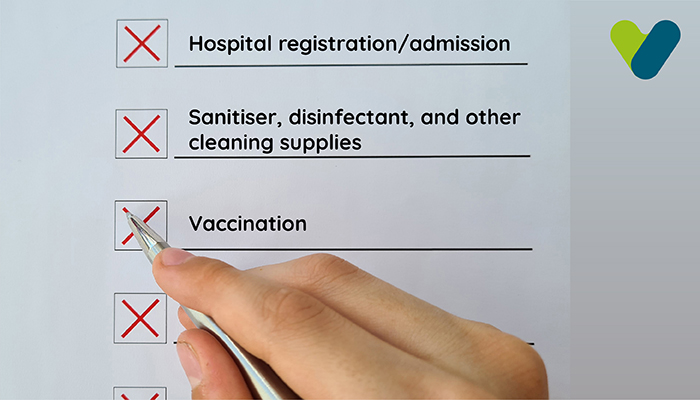

Health insurance providers usually categorise insurance plans into two types – indemnity plans and definite plans. However, they only offer the no-claim bonus on health insurance indemnity plans.Under indemnity plans, the insurance provider is only obligated to indemnify or reimburse you for the actual medical costs incurred when you file a medical insurance claim. Also, such plans generally come with lower sums insured, and the premiums are usually affordable. The standard indemnity plans include individual health insurance plans, family floater plans, senior citizen plans, etc.

In contrast, definite plans usually come with significantly high sums insured and are generally expensive, costing higher annual premiums. Also, the insurer disburses the entire sum insured in a single lump sum when you file a definite insurance claim. Insurers, therefore, do not provide the no-claims bonus benefit on definite policies like critical insurance health insurance plans, cancer policies, and personal accident insurance plans.

No Claims Bonus Health Insurance – Facts and Considerations

While NCB in health insurance offers money savings benefits, you must consider certain facts and considerations to qualify for this benefit.- Eligibility

- Progressive Increase

- Benefits Termination

- Transferability Clause

- Low Claims Value

Benefits of No Claims Bonus for Health Insurance

- The primary benefit of NCB health insurance is that it enables savings, irrespective of the type of NCB benefit your insurer offers.

- In the case of the discount benefit, you can save thousands of rupees in insurance premiums with every progressive policy year when you do not file a claim. The reduced premiums help you save money, which you can invest elsewhere.

- You also save a lot of money if your insurer offers the cumulative no-claims bonus benefit. While the insurer may not reduce the premium, the increased sums help you to get continuous coverage at the same price but with an increased coverage amount.

- With the continuously increasing medical costs, the increased coverage proves a boon due to its inflation-adjusted benefits. Thus, while the medical costs may increase with each passing year, your sum insured also increases. If you need hospitalisation and have to file an insurance claim, the increased sums insured reduce your out-of-pocket expenses if the costs are higher.

- A higher sum insured also means that you need not compromise while getting the best medical care, as opposed to only barely affordable treatment. You can consult reputed medical practitioners and seek medical treatment at the best healthcare facilities without worrying about costs.