Today, health insurance is a necessity. However, as a policyholder, sometimes you may feel discontented with your existing insurance plan. The reason for your disappointment could be a lack of adequate service or because you may have found another insurer offering a plan with greater coverage. It could also be because you may have experienced a hard time getting your existing insurer to settle a simple claim or because you may have had a bad experience reaching out to your insurer's customer care helpline. Whatever your reason may be, the Insurance Regulatory Development Authority of India (IRDAI) allows you to change your insurer through a process known as insurance policy porting. If you're wondering 'how can I port my health insurance policy', this article is for you. Read on to know more.

What Does Portability In Health Insurance Mean?

Health insurance portability is the process of transferring your existing health insurance plan to another insurance provider. It works the same way as SIM card porting, wherein you can switch to another network provider when your current network no longer works for you.

However, when you port health insurance plans, you can enjoy some specific advantages, including the ability to port your existing policy's sum insured, waiting period, and cumulative bonus to the new insurer. Better coverage, lower annual premiums, hassle-free claim settlement process, lifetime renewability, etc., are some standard reasons why people choose to port health insurance to a new insurance provider.

How To Port Health Insurance?

Assuming you have found a new insurance provider that meets all your insurance requirements, the next step is to know how to port medical insurance policy. While the process of porting policies may differ across insurers, the basic steps of how to port health insurance policy remain more or less the same across insurers offering this facility.

- Step 1: Approach the new insurance company

You need to contact the new insurance provider before your current policy ends. Per the IRDAI, you can port your policy only when it is due for renewal. You must apply for health insurance with the new company at least 45 days prior to your policy's renewal date but not earlier than 60 days. Go to the insurer's website, select the preferred insurance plan and click on 'Get Quote' or other relevant options. Provide your contact details so that the insurance company can get in touch with you.

- Step 2: Fill out the medical insurance portability form.

You will receive a few documents to fill out, including the health insurance portability form. In this form, you need to provide your personal and contact details. You also need to furnish the details of your existing insurer, including their and your name, policy number, insurance period, name of the plan, IRDAI product ID and policy type. You also need to provide details of the previous insurance plans held by you over the last four years. If you want to cover family members, you must also provide their insurance details. Select whether you wish to convert your cumulative bonus to an enhanced sum insured and provide your reasons for portability.

- Step 3: The new insurance company verifies your details with your existing insurer.

After filling out the form and submitting the relevant documents to the new insurer, the next step in how to port health insurance policy is verification. The new insurer contacts your existing insurer to verify your details, obtain your medical history, and assess your claim filing frequency. Per the IRDAI guidelines, the existing insurer must upload the requisite data on the IRDAI portal within seven working days of the request. If your existing insurer fails to do so, the IRDAI penalises them under the Insurance Act of 1938.

- Step 4: The new insurance company issues the health insurance policy.

After receiving the data from the existing insurer, the new insurer has 15 days to communicate their decision to approve or reject the portability application. However, if they do not inform the applicant within 15 days, the new insurer has no choice but to accept the application to port health insurance. The existing or new insurer cannot levy additional charges for the sake of portability. Until you receive your new policy, you can extend your existing policy on a pro-rata basis.

Documents Required To Port Health Insurance

A vital aspect of how to port health insurance is to submit the necessary documents. Most insurers typically ask for the following set of documents.

- Identity and address proof: PAN, Aadhaar, Driver's License, Passport, Voter ID, etc.

- Duly filled out and signed portability and proposal forms

- Copy of your existing medical insurance policy

- Insurance renewal notice

- Declaration stating no claims have been made, if applicable

- In case of claims: discharge summary, follow-up reports, etc.

Which Policies Are Eligible for Portability?

Now that you know how to port medical insurance policy, here are the types of health insurance plans you can port.

- All individual health insurance policies issued by general insurance and health insurance companies are eligible for porting. The same goes for family floater policies.

- If you are an insured member of a group health insurance policy, you may first migrate to an individual health insurance policy with the existing insurer. Then, you can opt for health insurance portability.

What Health Insurance Features Can You Port?

Besides knowing how to port health insurance, you should know what you can actually port:

One of the reasons why policyholders switch insurance providers is to avail of a higher sum insured. However, you must ride out the entire waiting period to get an enhanced sum insured.

Let's assume that you have been renewing a ₹5 Lakh policy without breaks for the past four years. However, you decide to port your policy with another insurer for a ₹7 Lakh sum insured. Now, if you need to cover medical expenses, you can claim ₹5 Lakh only. The additional ₹2 Lakh will be treated as a fresh sum insured, which will also be treated as a new policy when it comes to the waiting period and benefits provided.

Apart from the sum insured, portability also applies to cumulative bonuses you may have acquired during your policy period.

Assume your existing sum insured is ₹5 Lakh, for which you have accrued a ₹75,000 bonus. Upon porting your insurance policy, the new insurer has to offer you a sum insured of ₹5.75 Lakh and charge the premiums accordingly. However, if the new insurer does not offer a ₹5.75 Lakh coverage plan, they should offer the nearest higher plan. If the insurer offers a ₹6 Lakh sum insured plan, portability will only apply to ₹5.75 Lakh.

A policy's waiting period is an important factor when considering how to port health insurance. Also known as time-bound exclusions, the waiting period is the time during which you cannot file an insurance claim after the policy issuance. Let's say you have ridden out the waiting period on your current plan. If the new insurance plan has the same waiting period, you don't have to wait to make claims.

- Portability & Waiting Period

The waiting period is a crucial factor in health insurance. Therefore, when understanding how to port health insurance policy, you should also learn about the impact of portability on the waiting period. Let's understand the same with an example:

Let's say your current policy's waiting period for pre-existing conditions is 24 months.

- Scenario 1: Porting your policy after one year

Suppose you switch insurance providers after one year (12 months) of issuance of your existing policy. In that case, you will have to complete another one-year waiting period (another 12 months) upon porting, during which time you cannot file insurance claims.

- Scenario 2: Porting your policy after two years

In this case, you have ridden out your waiting period of 24 months. Therefore, you are allowed to file a medical insurance claim soon after porting your policy.

- Scenario 3: The waiting period for certain diseases is longer in the new policy

Sometimes, the waiting period for a certain treatment or ailment in the new policy can be greater than the waiting period for the same treatment or ailment in a previous policy. In such cases, the new insurer should convey the additional waiting period clause when you port health insurance.

- Scenario 4: You are a part of a group health insurance plan

If you're insured under a group health insurance plan and thinking, 'how to port my health insurance policy', do not fret. You can migrate to an induvial health insurance plan with the same insurance company. Now, when you port the individual plan with another insurer, you are not required to fulfil the time-bound exclusions provided you've already ridden them out under the group insurance plan.

Effect Of Portability On Existing Policy

When knowing how to port medical insurance policy, you should also understand where your existing policy stands:

- Your existing insurer can extend your existing plan while you wait for the health insurance portability approval. However, the extended plan must be on a pro-rata basis for a short period, not less than a month.

- The existing insurance company cannot cancel the policy until you receive confirmation from the new insurer that your portability request has been approved.

- The existing policy's end date, including that of the pro-rata insurance, should coincide with the new policy's commencement date.

- If you need to make an insurance claim during the portability period, your existing insurer has the right to charge the balance premium amount. Paying the annual premium allows you to use that policy for the remaining year.

Can Insurers Deny Health Insurance Portability?

All insurance providers offering health insurance products are mandated to acknowledge a health insurance portability request. However, the issuance of the policy is at the insurer's sole discretion. Therefore, besides knowing how to port health insurance policy, it is essential to understand on what grounds the new insurer can reject portability.

Furnishing the right details is crucial. This includes your policy details, pre-existing conditions, other insured persons' details, etc. Not providing accurate information may cause insurers to reject your porting request.

- Porting Request Not Made on Time

You must make the porting request on time, i.e., at least 45 days prior to the existing policy's renewal date, failing which the insurer may reject your porting request.

- Multiple Claims in the Past

The new insurer can track your medical and claim history. The higher the number of claims, the riskier the individual is deemed as a potential customer. A higher number of claims in the past may lead to rejection.

- Not Meeting the Age Criterion

Your age may exceed the new plan's maximum age limit. In such cases, the insurer is not obliged to accept your portability request.

- Non-coverage of Pre-existing Conditions

The medical insurance provider can instantly reject your application if the new policy does not cover a diagnosed pre-existing illness. Ensure you declare all pre-existing conditions beforehand.

- Expiry of Existing Policy

You cannot make a portability request after your existing policy expires. The new insurance provider will not let you apply for portability in the first place.

Essential Facts To Know Before Porting Health Insurance

Simply knowing the process of how to port medical insurance is not enough. You must consider the following crucial factors if you plan to port your insurance policy.

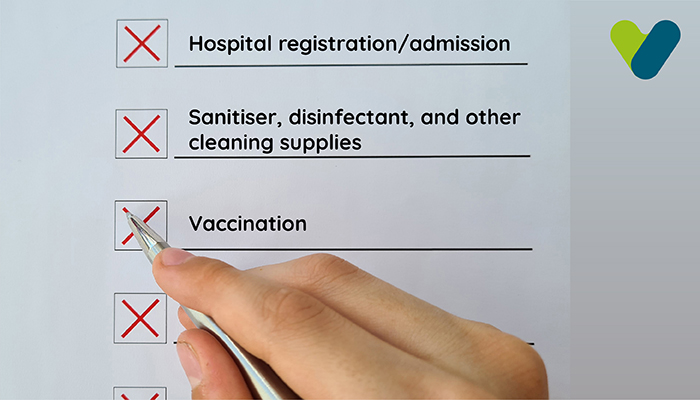

There are chances you may want to port for availing of lower insurance premiums. Lower premiums generally entail lower coverage which results in increased out-of-pocket expenses. Ensure you peruse the policy's inclusions and exclusions and conclude that the policy can indeed cover your medical needs.

- Sub-limits/Deductibles/Co-payments

Every medical insurance provider and insurance plan comes with its respective set of terms and conditions. You must thus check the co-payment clauses and any deductibles you may incur with your new policy. Higher sub-limits mean higher out-of-pocket expenses but lower annual premiums. If cost reduction is your motivation to port, you may want to check other plans.

Every health insurance policy is different, with different inclusion and exclusion terms. For instance, your existing policy may offer a daily hospital allowance of up to ₹5,000. Your new policy may offer only ₹2,500. You cannot expect the new insurer to offer the same benefit. You must accept the new policy and the benefits that come with it.

Is Health Insurance Portability Worth It?

Now that you know how to port health insurance policy and its nuances, let's retrospect the need for portability.

- What is your reason for switching insurers?

Porting a health insurance policy requires time; therefore, you should be 100% sure of your decision to port the policy. Suppose you were an insured member of a group health insurance policy or a previously dependent minor under a family plan who's now an independent adult. In that case, you might consider porting your insurance. Porting also makes sense if you are diagnosed with certain illnesses that your existing insurer does not cover.

- Is the new insurer better than the previous one?

Apart from the scope of coverage, you also need to consider the claim settlement ratio. If you find the claim settlement process of your existing insurer exhausting, you may consider porting. Having comprehensive coverage is not enough; a good customer support system is equally, if not more, important.

- Is affordability your reason for porting?

You can avail of lower premiums by porting your insurance plan. However, this can impact the policy's coverage. If you think the new policy can cover your medical expenses, you should opt for portability. The good news is that you can port health insurance as often as you wish without any additional cost.

Porting Vs. Migration

Knowing how to port health insurance helps you switch insurers. However, a process known as migration helps you switch insurance plans within the same insurance company. Like portability, your waiting period and other time-bound inclusions of the previous policy are protected. The following are insurance migration rules you ought to know.

- You can migrate from your individual health insurance, family floater policy or group insurance plan to another plan you prefer.

- You should convey your choice to migrate to a new plan to your insurer at least 30 days prior to the premium renewal date.

- You should complete the residual waiting period from the previous policy during your new policy's term.

- Apart from increasing the premium (if applicable), the insurer cannot levy additional migration charges.

Final Note: By now, we hope we've answered your question on 'how can I port my health insurance policy' satisfactorily. Whatever your reasons, ensure you conduct a cost-benefit analysis to confirm your motives for health insurance portability. The new insurer reduces your waiting period for the time you would have waited out during your last policy. You must also ensure you make the portability request before the renewal date, as it allows sufficient time for both the current and new insurers to complete the transfer process.