Uncertainties can knock at your door anytime, even when you are travelling. Hence, insuring your health with a travel health insurance policy is important as it protects you from financial burdens during your travels. Travel health insurance or, simply, travel insurance, covers unforeseen occurrences during your international travels such as accidents, dental emergencies, illnesses, etc. Moreover, the policy also covers you for costs associated with travel-related uncertainties, including loss of baggage, important travel documents like passport, trip cancellations and delays, missed connections, etc.

Travel health insurance companies cover you from the day your trip starts until you return to your home country, or the policy expiration date, whichever is earlier. Most insurers also offer cashless claim facilities upon receiving medical treatments at network hospitals worldwide. Round-the-clock availability allows you to file claims without fretting over the time zone differences.

Travel Health Insurance – What It Entails?

Travel medical insurance is an agreement between you and an insurance provider wherein the latter agrees to pay for the medical and non-medical costs incurred during your international travels, per the policy terms. If the country you're travelling to has a relatively high standard of living, the medical costs especially could most likely be sky-high. A travel medical insurance plan is thus a friend you can turn to during such challenging times. Keeping in mind the high medical costs, the best travel health insurance companies offer policies with high-value sums insured, ranging up to several thousand dollars. This way, you can receive the best medical care without worrying about the costs.

Features Of Travel Health Insurance

The following are the key features offered by some of the best travel health insurance companies in India.

Besides domestic network hospitals, insurers also have ties with international healthcare facilities. You can utilise the cashless claim facility, under which your insurer settles your international medical bills directly with the hospital where you're admitted for treatment.

You can select a number of tenure options. Depending on your travel duration and frequencies, you can choose single or multi-trip travel health insurance plans.

You can extend your single-trip insurance policy duration at an additional premium cost in case you are stuck in a foreign country due to medical emergencies or flight delays.

Given the different zones, insurance providers ensure that you can get round-the-clock assistance for all medical and travel expenses.

- Insurance For All Traveller Types

Whether you are an occasional traveller, frequent flier or a student, you can get travel health insurance with all types of travel plans such as single-trip, multi-trip, family plan, etc.

Reasons To Buy Travel Health Insurance

No matter how precisely you plan your trip, some things aren't in your control. However, mitigating the financial losses arising from such situations is definitely in your control, including buying travel health insurance. The following are some reasons why a travel health insurance policy is important when travelling abroad.

The Health Component Of Travel Health Insurance Plans

An important component of travel insurance is medical coverage. The health component of travel insurance covers you against the following expenses.

Your insurer will indemnify you for treatment costs associated with diseases, ailments or injuries first contracted or sustained during the trip. Expenses covered include doctor's fees, hospital services, medication costs, etc.

- Emergency Dental Treatments

Travel health insurance companies also cover dental illnesses that require immediate medical care, up to the sub-limits per policy wordings. Additionally, your insurer covers the cost of dental treatments resulting from accidental injuries.

In case of hospitalisation following an accident or illness, your insurance provider offers a daily hospital cash allowance to manage the everyday expenses. You can avail of a fixed amount of cash every day per policy wordings until you are discharged.

Your travel medical insurance covers the cost of transporting you to the nearest healthcare facility by land or air, as advised by an attending physician. Some insurers may also cover the emergency evacuation costs for an accompanying person.

In the event of the policyholder's demise, travel health insurance companies cover the costs required to transport the mortal remains of the insured deceased back to the origin country. The insurer may also cover the cost of local cremation or burial subject to sub-limits.

In case of accidental death, the insurer pays the lump sum benefit up to the specified limits to the nominees or legal heirs. The insurer also offers lump sum compensation in case of permanent total disability due to an accident abroad.

The Travel Component Of Travel Health Insurance

Besides medical expenses, travel insurance also covers non-medical expenses. They are as follows:

If your airline loses your checked-in baggage, the insurance company will reimburse you for the value of the checked baggage up to the specified limit upon submitting a property irregularity report (PIR) obtained from the airline.

If your passport gets stolen or you lose it, your insurer covers the necessary expenses required to procure emergency travel documents. However, the insurer is not liable to compensate for passport loss due to the insured person's negligence.

Travel health insurance companies cover the costs of trip cancellations under special circumstances. These include death in the policyholder's immediate family, sudden sickness, severe injuries, etc. You can also file claim for trips cancelled due to government-imposed travel bans.

If your trip gets delayed beyond a certain duration due to the airline's fault, your insurer will reimburse you for the same. You can avail of reimbursement up to the specified sum insured limit. The more the trip gets delayed, the more compensation you get.

If you are liable for accidental body injuries or damage to a third-party person or property, respectively, in a foreign country, your travel health insurance provider may compensate for such expenses up to the specified limit.

- Emergency Cash Assistance

Incidents like theft or robbery can cause a cash deficit, especially in a foreign land. In such cases, your insurer coordinates with your relatives in India to facilitate emergency cash assistance. Note that you must report the robbery, theft or pilferage within 24 to 48 hours, after which the insurer will not honour any claim requests.

Benefits Of Travel Health Insurance

Insuring yourself and your international travels is essential. Here are its benefits.

- Comes With Affordable Premiums

Travel insurance premiums are nominal and do not dent your savings. Depending on your travel type, you can usually avail of affordable policies protecting you against a plethora of high-cost medical bills and other unsolicited travel expenses.

Travel health insurance policies come with high sum insured options. A high sum insured ensures you receive adequate coverage for situations cited in your policy wordings. Given the sky-high medical costs in developed countries, a policy with a high sum insured can be beneficial.

- Facilitates Peace Of Mind

Whether you're travelling for work or leisure, you want your trips to be peaceful. A travel health insurance policy shelters you from unexpected costs. In exchange for a premium, your insurer promises to take care of the medical and non-medical costs based on your policy's coverage scope.

Medical costs can drain your savings instantly. Plus, healthcare in other countries can be expensive. From transportation to the nearest healthcare facility to providing a hospital daily cash allowance, your insurer covers the expenses on your behalf so that you don't have to use your savings to manage your expenses.

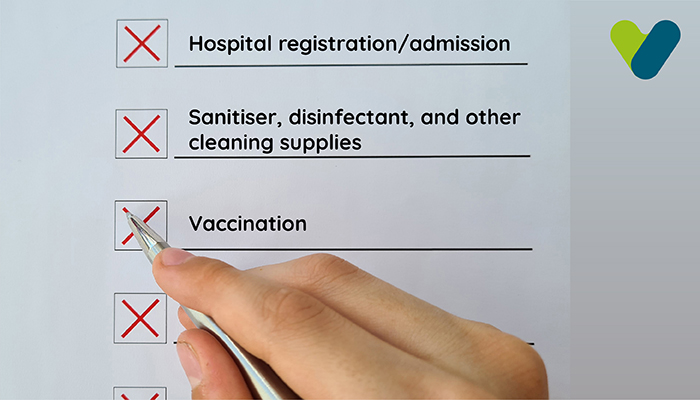

Travel Health Insurance Exclusions

While travel medical insurance covers most medical and travel expenses, the general exclusions are as follows:

- Travel Against Doctor's Advice

If you are undergoing treatment and decide to travel despite your doctor's explicit instructions not to do so, your insurer will reject your claims.

In case of attempted suicide or self-inflicted injuries sustained abroad, the insurer is not liable to reimburse you for the medical expenses.

- Sexually Transmitted Diseases (STDs)

Travel health insurance companies do not cover medical expenses associated with STDs such as HIV/AIDS or other venereal diseases.

Travel insurance does not cover medical complications arising due to pre-existing conditions during your international travels.

Your insurance provider does not cover medical costs resulting from intoxication or drug use, not prescribed by a medical practitioner.

- Injuries From Adventure Sports

If you have sustained injuries due to adventure sport activities like sky diving, scuba diving, paragliding, etc., your insurer is not obligated to cover the costs to treat such injuries.

Your insurer will not accept claims filed for treating mental illnesses such as bipolar disorders, depression, dementia, etc.

Your insurer will also not cover non-allopathic treatments like Ayurveda, Yoga and Naturopathy, Unani, Siddhi or Homeopathy, typically covered under general health insurance plans.

- War Or War-Like Conditions

Travel insurance does not cover medical costs arising due to your direct or indirect involvement in an invasion, civil unrest, rebellion, insurrection, etc., taking place in a foreign country.

Travel health insurance companies do not accept medical claims if the medical emergency is caused from being exposed to radioactive hazards.

What Is The Eligibility Criteria For Travel Health Insurance?

You can buy travel health insurance if you are:

- An Indian national travelling to a foreign country for business or leisure

- An Indian citizen travelling overseas for higher education

- Travelling overseas with your family

- A foreign national working in India

Travel health insurance companies typically do not set an age-range while determining eligibility. However, the eligibility criteria may differ across different travel health insurance providers. Therefore, you must read the policy terms carefully before buying your insurance plan.

Types Of Travel Medical Insurance Plans

Depending on your travel needs, your travel health insurance policy can vary. Insurance companies offer a multitude of travel insurance plans as listed below.

- Single-Trip Travel Health Insurance

A single-trip insurance policy covers medical and travel expenses for one return trip. The insurance benefits kick in when you start the trip and ends once you return to your origin country. As an occasional traveller, you can choose single-trip travel health insurance plans.

- Multi-Trip Travel Health Insurance

If you travel frequently, you can opt for a multi-trip travel insurance policy, usually valid for one year. You can take multiple trips during the policy year, with each trip lasting for a stipulated duration. Multi-trip policies are convenient if you travel for work frequently.

- Overseas Education Travel Health Insurance

This type of travel health insurance is customised for students travelling abroad for higher studies. Such a plan covers students for medical expenses, compassionate visits, study interruptions due to a family member being sick in the home country, etc.

- Family Travel Health Insurance

When travelling with your family, you can cover your family members under a single family travel health insurance plan. You may cover your spouse and dependent children. Some insurers may also allow you to include your parents under the age of 60 years.

- Senior Citizen Travel Health Insurance

Senior citizen travel insurance plans cater to individuals above 60 years of age. Since senior citizens require extensive medical care, their travel health insurance plans are designed to address the specific health concerns associated with old age.

- Domestic Travel Health Insurance

You can opt for a domestic travel health insurance policy if you are travelling within India. Some travel health insurance companies offer such policies, where you can avail of coverage for medical emergencies, disability following an accident, baggage losses, personal liabilities, etc.

How To Buy Travel Medical Insurance?

Follow these steps to secure your international travels.

- Compare Insurance Providers

You can compare insurance providers online. Shortlist a few reputed insures and visit their websites. In the navigation menu, select 'Travel Insurance' to view the list of travel health insurance offerings. Compare the policy's features, inclusions and exclusions, etc., and select the insurer that meets your criteria.

- Understand The Policy Type Suitable For Your Travel

Travel insurance premiums differ depending on the number of insured parties under one policy. It may also vary based on the type and frequency (single, multi-trip, etc.) of your chosen policy. Remember, each policy caters to different needs and may have different inclusions.

- Use A Travel Health Insurance Premium Calculator

You can use the insurer's travel health insurance calculator to compute your estimated insurance premium. Input your destination country, the number of travellers, their age and the start and end date of your trip. Provide your mobile number and email address to receive travel health insurance quotes.

- Verify The Inclusions And Exclusions Of Your Preferred Plan

Peruse the policy documents to familiarise yourself with the policy's scope of coverage. Check the medical coverage, i.e., hospitalisation expenses, sub-limits, daily hospital cash, etc. Also, read the non-medical coverage sections thoroughly. Make a note of the time limits for various sections for a convenient claim process.

You can make the payment for your travel medical insurance using your credit card, debit card, online banking facilities, digital wallets, etc. The insurer acknowledges your payment and issues the policy.

It also helps to take multiple hard copies of the policy in case your electronic devices are stolen, and you need to contact your insurer.

How To Choose The Best Travel Health Insurance Company?

The travel health insurance industry is a competitive one. Here's how you can choose from some of the best travel health insurance companies.

Since healthcare expenses can be higher in your travel destination, it helps to choose a plan with a substantially high sum insured. The best travel health insurance companies offer various plans with high sum insured options.

The insurance provider should offer different types of travel medical insurance policies such as single-trip, multi-trip, insurance for students, family plans, etc.

The best travel health insurance companies offer wide coverage for both medical and non-medical expenses. Look for companies that provide coverage for emergency hospitalisation, medical evacuation, hospital cash allowance, emergency dental treatment, etc. The insurer must also cover a wide range of travel expenses, including trip cancellations, baggage loss, etc.

Select insurance companies that cover the maximum number of countries. If you need to travel to multiple destinations, your insurance provider should be able to cover your various costs incurred in any of the foreign countries.

- Worldwide Hospital Network

Many travel health insurance companies now offer cashless claim settlements by empanelling hospitals in foreign countries. This facility allows you to receive emergency medical care with minimal out-of-pocket expenses.

- Efficient Customer Support

Since the time zones change when you travel overseas, your insurer must be equipped with a customer support team providing 24x7 assistance. Additionally, the customer support team should be equipped to handle all queries and claim requests efficiently.

The claim settlement time is one of the most important parameters you must consider. You can read online reviews and customer testimonials to assess an insurer's claim settlement period. You must also check the insurer's claim settlement ratio, which gives insight into the number of claims received and processed by the insurer.

- Renewal & Extension Process

Ensure you check the extension and renewal process followed by the insurance companies. You may require a policy extension if you're stuck in a foreign country due to medical emergencies or travel delays.

Travel Health Insurance Coverage For Coronavirus

In the aftermath of the coronavirus pandemic, many countries have insisted that visitors include a Covid cover under their travel insurance policy. Thus, most travel health insurance companies have started to include a Covid-19 cover under their plans. Such plans cover you against the following

Your travel insurance comes to your rescue if you're detected with Covid-19. Your insurer will reimburse you for medical expenses associated with Covid-19 treatment.

- Hospital Daily Cash Allowance

You can finance your everyday expenses while you're hospitalised with the daily cash allowance. You receive a fixed amount every day until you're discharged.

When you receive treatment at a network hospital, your insurer settles your medical bills directly with the hospital.

The insurer also covers the cost of repatriating the mortal remains of the policyholder in case of death due to Covid-19.

How To File Travel Insurance Claims?

You can file travel health insurance claims either of the two ways – cashless claims or reimbursement claims.

Some of the best travel health insurance companies have tie-ups with a vast network of hospitals in India and overseas. This feature allows you to receive cashless treatments at network hospitals even when you’re overseas, by following these simple steps.

- Inform your insurance provider about the medical emergency.

- Your insurance company or a third-party administrator (TPA) will share a list of network hospitals in the country where you need medical care along with the checklist of required documents.

- Duly fill out and sign the digital claim form.

- Send the list of documents and forms to the insurer.

- The insurer will keep you updated on the claim status.

Upon successful authentication, the insurer will settle your medical bills directly with the hospital.

If you are unable to reach the nearest network hospital, you can receive treatment at a non-network hospital. Your need to pay the medical bills yourself, and your insurer will reimburse you later. Here are the claim-filing steps.

- Inform your insurance provider that you will be filing a reimbursement claim. The insurer will send you the list of required documents.

- Reserve the original copies of all the medical bills, reports and relevant documents.

- After discharge, duly fill out and sign the claim form.

- Send all the required documents along with the claim form to your insurer via email.

- The insurer will evaluate your claim. If you are eligible, they will reimburse you within 30 days.

Note that travel health insurance companies can reject your claims if they find that claims were filed on the grounds of circumstances not covered by the insurer. In such cases, you must pay for the expenses from your own pocket.

How To Extend Travel Insurance?

Your trip duration is one of the important factors that determine your travel health insurance premium. However, unforeseen situations like medical emergencies or delays in public transportation can force you to extend your trip. Therefore, it is imperative that you stay insured for the extended duration as well. You can follow these steps to extend your travel medical insurance.

- Contact your insurer via email or customer support.

- Describe your reason for extension in detail, along with your existing travel insurance policy's details.

- Your insurer will send you the extension form and the required document checklist.

- For flight delays or cancellations, you need to acquire an official document from the airline stating the cancellation details.

- For medical emergencies, you need to submit a medical certificate issued by the international hospital.

- In the extension form, provide your name, policy number, policy type, insurance period, etc. State the required extension period along with the reason for the extension. You need to provide details of any claims filed during the existing policy period as well.

- Send the extension form along with the documents to your insurer via email.

- Your insurer may send you a payment link for the additional premium payment.

- Make the payment using your credit card, debit card, net banking platform, etc.

Conditions Pertaining To Travel Health Insurance Extension:

- The existing policy should not have expired.

- You should not have filed a medical claim on the existing policy.

- The existing policy can be extended for up to 180 days only.

- You should make the request for an extension at least a week before the current policy expires to ensure continuity.