If you don't like something, change it. This rule applies to many things in our lives, including health insurance. Keeping up with the inflating medical costs is not everyone's cup of tea which is why health insurance is crucial in today's time. Under a health insurance plan, your insurance provider covers your medical expenses associated with the treatment of a multitude of diseases and ailments. However, if you are dissatisfied with your existing insurance provider, you change your health insurance plan without losing its benefits under a process known as porting of health insurance. Continue reading to know more about health insurance porting.

What Does Porting Of Health Insurance Mean?

The process of transferring your health insurance from your existing insurance provider to another insurance provider is known as health insurance porting. You can port health insurance for a number of reasons. For instance, if you find an insurance plan offering similar or better coverage at a lower rate, or if your existing insurance provider does not provide a satisfactory claim settlement process, you can consider porting your health insurance policy. The process works in more or less the same way as mobile number porting, wherein you can change service providers without changing your mobile number.

The Insurance Regulatory and Development Authority of India (IRDAI) has laid out some specific guidelines pertaining to porting your health insurance policy. Under these guidelines, you, your existing insurer and the new insurer must complete the porting process during a specific time during the policy period. Additionally, even of you opt for porting of health insurance policy, your can continue enjoying the benefits accrued on your existing insurance plan such as the lapsed waiting period, accumulated cumulative bonuses, etc.

The Need For Porting Of Health Insurance

Even before portability came into effect, policyholders would transfer their health insurance policies to another company if they were dissatisfied with their insurer's services. However, they would lose their bonuses and benefits of reduced waiting periods. To protect policyholders from discontinuity and consequential loss, the IRDAI standardised portability with effect from 1st July 2011.

Components Of Health Insurance Portability

There are two main components of health insurance portability, under which the insurer can consider you eligible for porting.

- Sums Insured and Cumulative Bonuses

When it comes to insurance, the sum insured is the maximum amount an insurance company can pay you within a policy year. When you don't file claims, the insurer rewards you with cumulative bonuses, which you can use to enhance your sum insured. You can port your existing sum insured along with all the cumulative bonuses. Per the IRDAI porting guidelines, the new insurer must provide coverage of at least the minimum sum insured in the previous policy.

Let's say your existing health insurance plan has a sum insured of ₹5 lakh and a cumulative bonus of ₹75,000. When you switch your insurer, the new insurer has to offer a sum insured of ₹5.75 lakh with the new applicable premium. If the new insurer does not have a health insurance plan of ₹5.75 lakh, they must offer the nearest higher plan. The new insurer may offer a plan of ₹6 lakh sum insured and charge the applicable premium.

After purchasing a health insurance policy, your insurance benefits do not kick in from day one. You need to ride out a certain period of time before your insurer starts accepting your claim requests. This period is called the waiting period. You typically have to ride out the initial waiting period of 30-90 days for regular health insurance plans, one to two years for pre-existing diseases, two to four years for critical illness plans and nine months to four years for maternity coverage plans.

Let's say your existing policy had an initial waiting period of 60 days and a pre-existing diseases rider with a waiting period of two years. You've been renewing the policy for three years now.

- Scenario 1: When the waiting period for new and existing plans are same

Since you've continuously renewed your policy for three years, you've already ridden out the waiting periods. After health insurance policy porting, you can immediately start filing claims.

- Scenario 2: When the waiting period for new and existing plans is different

If the new plan's waiting period for pre-existing diseases is four years, you need to ride out an additional one-year waiting period. After a year, your new insurer will accept your claim requests.

Porting Health Insurance Policy When You're Part of Family Floater Plan

Porting applies to individual health insurance as well as family floater plans. For family plans, you can port the other insured members under the plan as well. However, if you wish to switch insurers by yourself, you must exit the family plan first. You can migrate to an individual plan with your existing insurer. Then, you can transfer your existing individual insurance plan to another insurance company.

Porting Health Insurance Policy When You're Part of Group Health Insurance

You can port to an individual medical insurance policy if you're part of a corporate group health insurance plan. However, like a family floater plan, you need to migrate to an individual policy with your existing insurer. You can now port your individual plan to another insurer.

Facts To Consider When You Port Health Insurance

The IRDAI is the regulatory body for everything-insurance in the country. The following are the porting rules set by this entity.

- Types of Policies You Can Port

When porting, the new plan should be similar to your existing plan. However, if you want the new insurer to provide additional coverage options or a higher sum insured, the new premium will be based on such additions. You can port your indemnity-based individual, family floater and group health insurance plans to other general insurance companies or health insurance companies.

Per IRDAI guidelines, the existing insurer and the new insurer cannot levy charges when you opt for portability. However, you must pay additional costs such as premium hikes if you opt for a similar policy but with higher sums insured, since higher financial coverage leads to higher costs.

- Timelines for Policyholders

You can port medical insurance during the existing policy's renewal period only. You must inform your insurer about your porting plans and apply for the new policy during the 45 -60 days period before the existing policy's renewal date. Also, the new insurer may accept your application, provided you have renewed your existing policy regularly, without breaks.

- Timelines for the Existing Insurer

When the new insurer contacts your existing insurer to obtain your medical and claim history, your existing insurer must upload the required data on the IRDAI portal within seven days.

- Timelines for the New Insurer

After receiving your data from your existing insurance, the new insurer must convey their decision to approve or reject your porting request within 15 days. If the new insurer fails to do so, they are obligated to approve your health policy porting request.

- Extension of Existing Policy

If your existing policy is due for renewal and the new insurer has not yet conveyed the outcome, your existing insurer can extend your existing policy on a pro-rata premium for up to one month.

- Claims Files During the Pro-Rata Period

The existing insurer accepts your claims filed during the extended policy duration. If the claim is accepted, the existing insurer can charge the balance premium amount. However, if you pay the balance premium, you essentially renew your existing policy. Therefore, you can continue using your existing policy and try porting it during the next renewal period.

Steps To Port Health Insurance Policy Online

The process of Porting of health insurance is incredibly simple. Here's are the steps to follow.

- Inform your insurer about your plans to port health insurance at least 45 days before your existing policy's renewal date.

- Contact the new insurance company. On their website, provide your name and contact details. An insurer's representative will contact you shortly.

- Inform the representative about health insurance porting. The new insurer will send you the documents you need to submit.

- After submitting the required documents, the new insurer will contact your existing insurer.

- Your existing insurer will upload your medical documents, medical history, claim history, etc., in the prescribed format on the IRDAI web portal within seven days.

- Upon receiving the data from the existing insurer, the new insurer may underwrite a proposal and inform you of their decision to approve or reject the application.

- Ensure that the new policy's start date coincides with your existing policy's end date so that you are covered without any breaks.

Note that the porting process may differ from insurer to insurer and checking the exact procedure with your insurers is essential.

Documents Required To Port Health Insurance Policy Online

You must submit these documents during the process of porting of health insurance policy to the new insurer.

- Age, identity and address proof documents

- Duly filled out and signed health insurance proposal form

- Duly filled out and signed portability form

- Copies of your existing policies

- Declaration of no-claims

- Medical history documents

What Is A Portability Form?

A health insurance portability form is a document that allows the new insurer to check your existing insurance details along with the reason for porting health insurance. The following are crucial components of the portability form that you need to fill out correctly.

- Existing Insurer's Details

You must provide details like your existing insurer's name, your plan's policy number, period of insurance, plan name, type of policy, and IRDAI product ID.

You need to list the name, gender, date of birth, age, Aadhaar and Permanent Account Number (PAN), member ID, etc., of all insured members in your existing plan.

- Details of the Proposed Insurance Plan

You must provide the name of the proposer, i.e., the new insurer's full company name along with the new product's name.

Select whether you would like to convert your cumulative bonuses into an enhanced sum insured coverage.

You must mention the reason for your portability request from the list of reasons already provided in the form.

- Details of the Previous Insurers

You need to provide the insurance details, i.e., the insurer's name and policy number for the last four or five years. This allows the new insurer to track and evaluate your medical and claim history with the previous insurers.

Reasons to Port Health Insurance Plans?

You can port your health insurance policy for various reasons, as often as you like. However, the following are common reasons for porting.

- Service Issues with Existing Insurer

Switching insurers would be a good idea if you've faced service issues with your current insurance provider. Incidents like the insurer not offering prompt customer service, delay in policy issuance, not notifying the policyholder about renewals or premium hikes, etc, come under the purview of service issues.

Inflation impacts every industry, so insurance companies may increase the premium costs annually. If you find the costs too expensive, you can consider porting of Mediclaim policy and finding a cheaper alternative.

- High Co-payments and Deductibles

Co-payments and deductibles are fixed amounts or percentages of the sum insured you need to pay from your own pocket while undergoing treatment. You can find an insurer that offers health insurance without these clauses.

- Delay in Claim Settlements

Your existing insurer's inability to process claims on time is a solid reason to port health insurance. To ensure that the new insurer has an efficient claim process, you can read online customer reviews and check their claim settlement ratio.

- Wrong Claim Repudiation by Current Insurer

The decision to approve or reject an insurance claim lies with the insurer. However, the insurer must provide a repudiation letter explaining the reasons for claim rejection. If you believe the reasons to be false, even after making multiple appeals, you should consider changing your insurer.

Hidden costs can strain your financial and mental well-being, especially during a medical emergency. Your insurer must state all such costs in the policy document. Insurers shouldn't levy charges not mentioned in the policy wordings.

- Upgrading to a Better Plan

Health needs keep changing. Therefore, it is important to keep upgrading your health insurance policy as well. You can find betters plans with your existing insurance. However, if you don't, you can always port to another insurer offering better plans.

- Similar Coverage at Lower Costs

Given how competitive the health insurance industry is, you can find numerous insurance plans, each with different inclusions and coverage options. You can easily find a similar policy as your existing one with lower premiums.

Porting Of Mediclaim Policy

Mediclaim is a type of health insurance policy that mainly covers hospitalisation expenses. Porting of your medical policy is also possible, and you can follow the same steps applicable to individual and family floater health insurance plans.

Benefits Of Porting Health Insurance Policy

You need not port your policy only if you are dissatisfied. There are some excellent benefits of porting a health insurance policy from one insurer to another.

The process for health policy porting is straightforward. You just need to keep in mind the timeline to port your policy. As long as you make the application for porting your plan before 45 days of your existing policy's renewal date and submit the right documents, your porting process should be seamless. Also, the new insurer verifies your medical history directly with the current insurer. Therefore, the documentation process is also hassle-free.

The greatest benefit of porting health insurance policy is the protection of the lapsed waiting period. If you've served the waiting period in your existing policy, you are not required to ride out the new policy's waiting period, provided the two policies have the same waiting period. Even if the new policy's waiting period is longer, you only need to ride out the extra waiting period. This way, you can avail of a reduction in your waiting period.

- Carrying Forward Cumulative Bonuses

When you don't file claims during a policy year, your insurer offers a no-claim bonus wherein you can either avail of discounts on subsequent health insurance premiums or increase the sum insured percentage. These cumulative bonuses can go as high as 50% over five consecutive claim-free years. When you port to a new insurance company, the bonuses you've earned previously are retained in the new plan. You can convert your cumulative bonuses into an enhanced sum insured amount.

Porting gives you the opportunity to explore comprehensive plans from other insurers. You can opt for insurance plans with better coverage. You can improve your insurance plan by looking for policies that offer coverage for, outpatient department (OPD) treatments, mental health cover, domiciliary hospitalisation, AYUSH treatments, critical illness cover, etc.

Can The New Insurer Deny Porting Of Health Insurance Policy?

All health insurance companies are required to acknowledge porting requests. However, accepting or rejecting the request is at the sole discretion of the insurer, and they may deny your porting requests, under the following grounds.

- Porting Request Made After the Timeline

The new insurer requires adequate time to process your application, verify your medical and claim history, underwrite the proposal form, etc. Therefore, the insurer can reject your application if you apply for porting after the stipulated time.

- Existing Policy's Expiration

Porting health insurance is only applicable when your existing policy is ongoing but days away from being due for renewal. If your existing policy expires, not only can you not port health insurance, but you also lose your cumulative bonuses and lapsed waiting periods.

The more an individual files insurance claims, the more insurance providers deem them risky. Your new insurer can track your claim history. Therefore, a higher number of claims filed with the previous insurers could be a valid reason for the new insurer's rejection.

- Missing or False Information

When you port health insurance policy online, the policy details of previous insurers, pre-existing conditions, the identity of other insured members, etc., is important data you need to provide. Missing information or not declaring pre-existing conditions can lead to rejection.

- Not Meeting the Entry-age Eligibility

Different insurance plans have different entry ages. Some plans may not have a maximum entry age limit, while some have it. Hence, it is important to declare your age during the initial stages of application so that the insurer can offer suitable plans and you can avoid rejection.

- Not Specifying Pre-existing Conditions

If the new insurance plan does not cover pre-existing diseases like asthma, cholesterol, thyroid, diabetes or other specific diseases, your application can get rejected. When you want to port health insurance policy online, ensure you conduct your due diligence and read the policy inclusions.

Factors To Consider When You Port Health Insurance

The following are the important aspects you must consider when you want to port health insurance policy online.

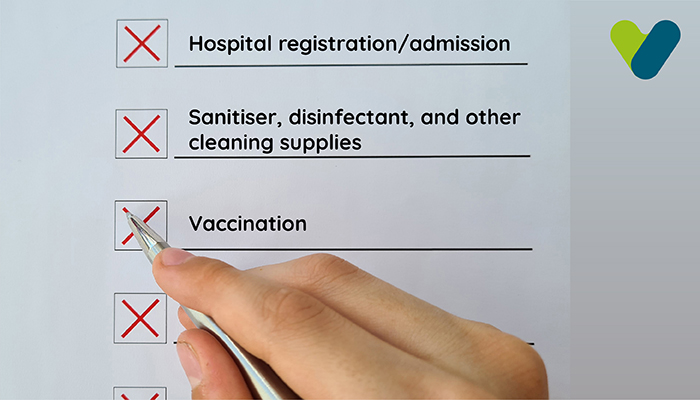

- Insurance Components Not Applicable for Portability

Insurance portability is only applicable to your existing plan's sum insured, waiting period and cumulative bonuses and not to the policy's features and inclusions. So assume, your existing policy has a ₹5,000 room rent cap, while your new policy has a ₹4,500 room rent cap. You cannot port the higher room rent cap from your previous insurer. Let's say both existing and new policies cover 500 day care treatments; however, the new plan has a few different day care treatments. Porting will not be applicable here as well.

- Change in Premium and Coverage

If your reason for porting of health insurance is better coverage, there's a chance that your premium cost will also increase. On the other hand, if you're porting to avail of a lower premium, there could be a change in the policy inclusions. Hence, when you port medical insurance policies online, it is imperative that you peruse the policy conditions and investigate the reason for the difference in the premium prices.

Policy terms differ across insurance providers. Therefore, porting of Mediclaim policy or regular health insurance plans entails different policy terms listed in the policy documents. For instance, your existing plan allows pre-authorisation for cashless treatments one week before; however, the new plan may require you to complete pre-authorisation 10 days before the treatment.

Can You Port Health Insurance Policy With The Same Insurer?

Technically, you can port health insurance policy with the same insurer. When you change insurance policies but not insurance providers, the process is known as policy migration. Migration is helpful when you want to switch from:

- A family floater plan to an individual plan

- A group health insurance plan to an individual plan

- An individual plan to an improved individual health insurance plan

Also, your sum insured, cumulative bonuses, waiting period, and other time-bound exclusions are carried forward during policy migration. However, the timeline to inform your insurer is at least 30 days prior to your existing policy's renewal. Per IRDAI norms, your insurer cannot levy additional charges to migrate your policy.

Porting Of Health Insurance – Tips To Select A New Insurer

After deciding to port medical insurance, you must choose the new insurer. Here are some helpful tips to help select a better insurance provider.

- Compare Multiple Insurance Companies

The competitive advantage allows you to find better products. Compare numerous insurance companies and their health insurance offerings. Assess the inclusions and exclusions along with their process for health policy porting.

- Check Their Claim Settlement Ratio

Ensure the new insurer has a better or higher claim settlement ratio than your existing customer. A better ratio indicates your insurer's financial health.

- Check Their Network Hospitals

Receiving treatment at a network hospital means little to no out-of-pocket expenses. You can check the hospital list on the insurer's website. Ensure the new company has several network hospitals in your proximity for immediate healthcare.

- Check the Insurer's Clauses Pertaining to Co-payments and Deductibles

Co-payments and deductibles are fixed amounts or percentages of the total medical expenses you must bear during a medical claim while the insurer covers the rest. You must check if these clauses are included in the newly ported policy. Also, check if the insurer allows you to remove these clauses altogether. However policies without porting and co-payment clauses may cost more in terms of premiums.

There's no better way to gauge a company than customer reviews. You can find numerous reviews on the internet, read customer testimonies, ask questions on online forums, etc.

Final Note: Thanks to IRDAI regulations, porting is more standardised than ever. You can opt for health insurance policy porting to avail of better services, better coverage, and affordable premiums. Moreover, your cumulative bonuses and waiting periods are retained. When you change from one insurer to another, you must abide by the new insurer's terms. Therefore, ensure you read the new plan's terms and conditions thoroughly and remember to raise the porting request on time.