Health insurance is an extremely useful tool used by many people to navigate through a medical crisis. Since the process of buying and/or claiming insurance is a little complicated, you may get confused and wonder “What are the documents required for health insurance?”

Here’s a rundown of the health insurance documents needed for purchasing a plan and settling claims.

Documents required for buying medical insurance

At the time of purchasing health insurance policy, the insurance company will likely ask you for the following set of documents to process your application. It is important to provide accurate and updated information as both parties (the insurer and the insured) will be entering a contractual financial agreement.- Proof of identity

Documents such as a passport, an Aadhar card, a voter ID, and a driving license are widely accepted as proofs of identity.

- Proof of age

- Aadhaar card

- Driving license

- Voter ID

- Passport

- Birth certificate

- PAN card

- 10th or 12th standard mark sheet

- Proof of address

If you move elsewhere, you should update your insurance company about your new permanent/temporary address. Following is a list of acceptable documents for address proof:

- Aadhaar card

- Telephone or electricity bill

- Ration card

- Rent agreement

- Passport

- Driving license

- Voter ID

- Passport-size photograph

- Medical reports

Few insurers may demand additional documents along with a duly filled proposal form. If the chosen plan provides coverage for your family members, then the documents of your family members will also be needed to process the application for a floater/family plan.

Documents required for claiming medical insurance

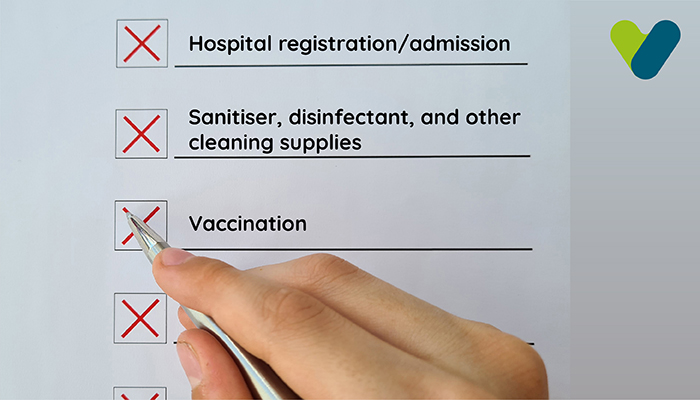

Insurance companies ask for documents to check the integrity of a claim request, and the claim is settled only after confirming the information’s authenticity.There are two ways in which you can raise a claim request—cashless claim and reimbursement.

- Documents required for cashless claim settlement

- Health insurance documents for reimbursement claim

- Valid identity proof or health card provided by your insurer

- Doctor’s consultation forms

- Investigative and diagnostic reports

- Medical bills and receipts

- Original pharmacy bills

- Original discharge summary

- Medico-legal certificate (MLC) or first information report (FIR, applicable in case of an accident)

- Additional documents as requested by the insurance provider to support the authenticity of your claim

Final word of caution

Health insurance documents include crucial information about you. Hence, it is important that you take utmost care while submitting documents such as Aadhar card, PAN card, voter ID, and passport to any insurance provider.Mention the purpose of sharing personal information in the application form to safeguard yourself from fraud and/or identity theft.